Bitcoin is set for a second straight quarterly gain, tightening its grip on crypto markets as smaller tokens nurse losses.

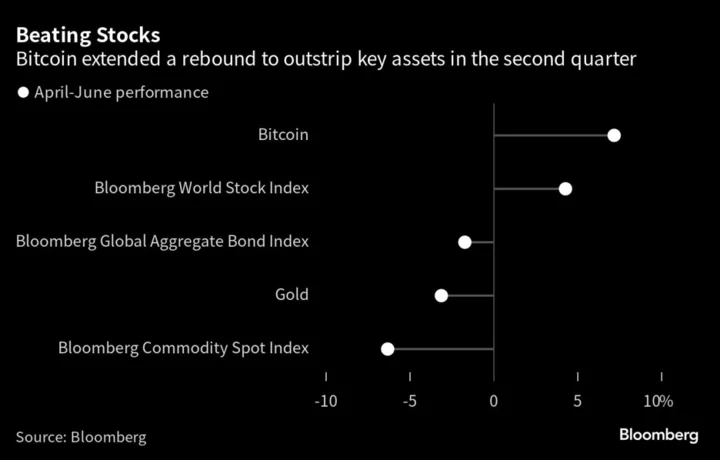

The largest digital asset is up 9.4% in April through June, aided by optimism about increasing demand if BlackRock Inc., Fidelity Investments and others succeed in their efforts to start spot Bitcoin exchange-traded funds in the US.

In contrast, smaller tokens have been weighed down by the US Securities and Exchange Commission’s growing list of coins viewed as unregistered securities, a designation that can make those assets harder to trade. Bitcoin doesn’t face a similar overhang because American officials view it as a commodity.

An index comprising the bottom half of the top 100 tokens by market value is down 24% this quarter. The divergence between Bitcoin’s performance over the period and the latter gauge is the widest since the last three months of 2020. That’s even with an end-of-quarterly rally in tokens such as Bitcoin Cash and Litecoin.

Bitcoin’s dominance of the crypto market “is likely to strengthen amid regulatory uncertainty,” said Caroline Mauron, co-founder of digital-asset derivatives liquidity provider OrBit Markets.

“There was a flurry of derivatives activity on the tokens singled out by the SEC lawsuits, with some traders looking to take advantage and pick the bottom, while others attempted to hedge their exposure by buying puts,” Mauron added.

Institutional Players

The attempts by financial titans to launch ETFs, as well as other signs of institutional crypto interest, have helped to extend Bitcoin’s 2023 rebound to 87%. In addition, a global cycle of monetary tightening is closer to an end, easing some of the worst fears about the drag on sentiment from rising rates.

“The finishing line for the Fed’s rate hiking cycle is in sight,” said Tony Sycamore, a market analyst at IG Australia Pty. He expects Bitcoin to climb in the third quarter and has an initial target of $32,375 based on chart patterns.

Prognosticators are generally less upbeat about smaller tokens — or altcoins — as the US pursues a crypto crackdown after a market rout and spate of blowups last year that depressed digital-asset liquidity.

The SEC in June labeled 19 coins unregistered securities in lawsuits against the Binance Holdings Ltd. and Coinbase Global Inc. crypto exchanges. The list spans tokens such as Binance’s BNB, Cardano’s ADA and Solana’s SOL.

A number of crypto exchanges responded by limiting their exposure to some of those tokens. The 19 coins have shed about $16 billion of market value since the SEC’s move, according to CryptoQuant figures.

“The current altcoin bear market could persist for several more months,” Jamie Douglas Coutts, senior market structure analyst at Bloomberg Intelligence, wrote in a note.

Options Expiry

Bitcoin now accounts for nearly 49% of the $1.2 trillion crypto market, its highest share in more than two years, according to CoinGecko figures.

Investors are monitoring the end-June expiry of Bitcoin options with a notional value of almost $4.9 billion, based on data from derivatives exchange Deribit.

There’s a tilt toward bullish bets around the $30,000 strike price and if the token maintains upward momentum “we could see a scramble in the market to buy Bitcoin as dealers will need to deliver on exercised calls,” wrote Noelle Acheson, author of the Crypto Is Macro Now newsletter.

(Updates to note performance of altcoins on Friday in the fourth paragraph.)