By Michael S. Derby and Dan Burns

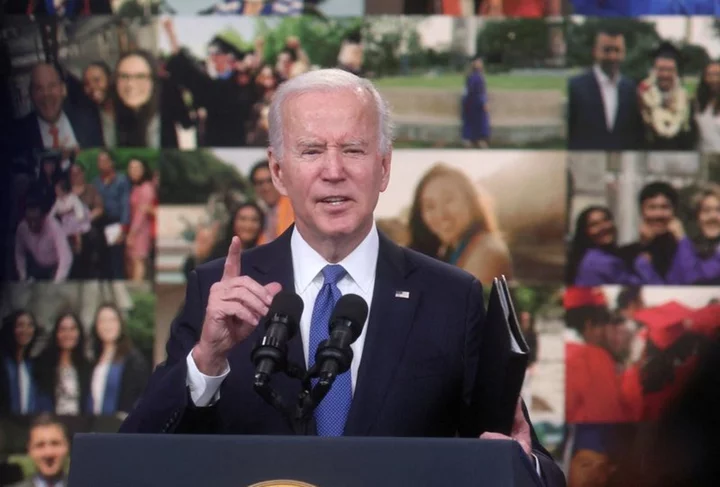

The U.S. Supreme Court's striking down of President Joe Biden's student loan forgiveness plan puts nearly half a trillion dollars of debt back on household balance sheets, a burden that combined with the end of a pandemic-era pause in payments on education loans may hasten an anticipated year-end economic slowdown.

The court's 6-3 ruling on Friday, widely expected to go against Biden, comes just weeks after the White House and congressional Republicans struck a deal to lift the federal debt ceiling that included prohibiting any further extensions of the student debt payment hiatus put in place in early 2020 at the onset of the COVID-19 pandemic. The Education Department last week said loan payments would resume in October.

That means U.S. households who collectively owe $1.6 trillion in education debt must restart making hundreds of dollars a month in loan payments for the first time in more than three years. New York Fed research from earlier this year said around $440 billion in loans were eligible for relief and if they had been permanently eliminated it would have left 40% of student loan borrowers with no student loan debt.

Economists expect restarted payments to have a meaningful effect on consumer spending but vary in their views of how serious the pain will be.

Thus far, consumers' spending power has defied broad predictions of a steep falloff in the face of the sharp rise in interest rates engineered by the Federal Reserve to rein in inflation. In the 12 months through May, consumer spending had grown at an annualized rate of 5.9%, nearly 2 percentage points above the prevailing growth rate before the pandemic.

But questions remain about the resilience of consumer spending, a key driver of economic growth, especially with the prospect of more rate rises remaining on the table.

"I have been anticipating a pretty significant impact on consumer spending as soon as the payments start again," said Thomas Simons, U.S. economist with investment bank Jefferies. "My suspicion is that most of the folks who are going to have to start paying again have limited capacity to handle the increased expense" while navigating other financial challenges.

"I expect that this is going to be the tipping point that puts the economy into a recession," Simons warned.

Economists at Morgan Stanley, meanwhile, predict that reimposing loan repayments will have a tangible - but modest - impact on growth in the closing months of the year. Unlike Jefferies, the bank does not see a U.S. recession, but agrees personal expenditures will take a hit and the nation's gross domestic product growth is likely to be between 6 and 9 basis points lower than it would otherwise be.

Morgan Stanley noted that the typical monthly interest payment that would need to be made would range from $200 to $300, which means those affected are likely to see their disposable incomes reduced by 0.3% to 0.5% each year from what they would have been had the student loan forbearance remained in place.

BEARING THE BURDEN

That said, there remains a substantial amount of uncertainty as to how all of this will play out and how it will manifest in the economy. Some of it depends on how the Biden administration manages the aftermath of the ruling.

Who will bear the burden of restarted payments is somewhat in contention. Some economists who opposed the loan payback moratorium had viewed the effort as a gift to affluent Americans, arguing high loan levels have been a solid investment to bolster future earnings.

But researchers at the New York Fed have pushed back at that notion and analysis from the bank over recent months suggests restarted payments will weigh most on those who might have trouble dealing with it.

A New York Fed paper from January noted that those who would stand to benefit the most from the debt payback holiday were "younger, have lower credit scores, and live in lower-income neighborhoods." It said signs that some student loan borrowers were having trouble handling credit card and auto loan debt "may portend more widespread payment difficulties for borrowers if payments resume without relief."

Another challenge to at least some of those who face student loan repayment: Managing new debt taken on when student loan payments were off the table. The New York Fed found the debt payment holiday boosted credit scores of student loan borrowers, opening the door to take on other debt.

Indeed, a paper earlier this year from the University of Chicago noted that on balance those benefiting from the moratorium did not use the extra cash to pay down existing loans and instead spent what turned out to be a temporary windfall, with some of these expenditures being debt fueled.

Delinquency rates on student loans plummeted from roughly 10% before the payment holiday to below 1% at the end of the first quarter of this year. A White House official said the administration was worried about some borrowers' ability to repay their loans, and that there was very strong reason to be concerned about delinquencies and default.

Research from the Fed, released in May, suggests a return to loan payments may bring some credit stress, noting that those who had enjoyed the relief "were able to improve their credit profiles."

(Reporting By Michael S. Derby and Dan Burns; Editing by Andrea Ricci)