Bayer AG hired several teams of bankers for a strategy simulation game that studied various breakup scenarios, according to people familiar with the matter. Their conclusion: Sweeping changes to the troubled German conglomerate won’t be easy.

The Leverkusen-based company hired two separate teams as it explored the pros and cons of a breakup, said the people, who asked not to be identified as the talks are private. Team Red simulated an activist campaign calling for splitting up Bayer’s businesses, the people said. Team Blue advised on how to respond to the approach.

Bayer came to the conclusion that it should avoid responding to any potential calls for a breakup until the company finishes its own strategic review so as to avoid raising expectations among shareholders, the people said. The simulation took place before Bayer announced third-quarter results and a recent series of high-profile setbacks, but it hasn’t yielded new results in the meantime.

Stock Slump

The German conglomerate’s shares suffered their biggest drop ever on Nov. 20, losing about €7.3 billion ($8 billion) in market value, after major courtroom and drug-development setbacks raised pressure on its new leader to outline a turnaround plan. Bill Anderson, who became chief executive officer in June, said earlier this month that he’s weighing whether to separate its consumer-health or crop-science operations.

The simulation found that any divestiture of Bayer’s consumer health business would likely trigger a massive tax hit potentially jeopardizing the benefits of a deal, the people said.

To be sure, the review hasn’t been completed yet and Bayer may either find a more tax-efficient structure or a buyer willing to pay a significant premium, they added. Thyssenkrupp AG, for instance, sold its elevator unit at a substantial premium in 2021 without incurring a major tax bill.

“Depending on what you would separate and how you do it, you create a taxable event that could require you to write a very big check before you get any money in,” Chief Financial Officer Wolfgang Nickl said last week. “And that would be one situation where it would be actually detrimental to the debt situation.”

Bayer stock fell as much as 1.7% in Frankfurt morning trading Tuesday. The benchmark DAX index was down 0.2% at 9:24 a.m. in Germany.

A representative for Bayer declined to comment.

Activist Pressure

Anderson at times has highlighted the fact that some investors are happy with the current strategy, which has different units focused on pharmaceuticals, consumer health and crop science. Earlier this month, he ruled out a simultaneous three-way split, even as some investors, including activist Bluebell Capital Partners, have renewed calls for doing so.

Bayer could either sell the consumer-health business outright, conduct an IPO or spin the division off, Anderson has said. Bayer is now evaluating with its external advisers how those different routes could impact Bayer’s ability to pay down its high debt burden.

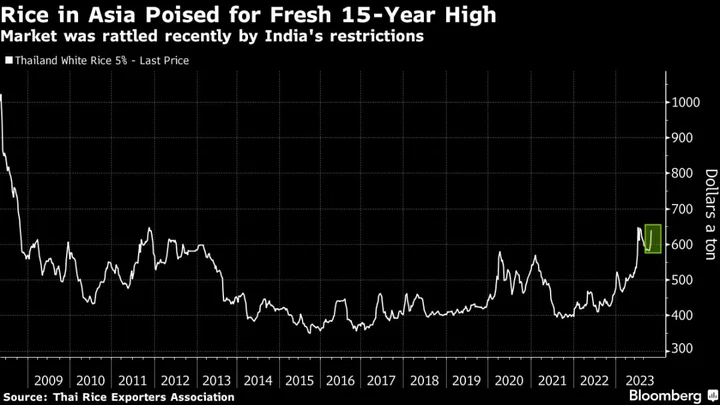

Hiving off its crop-science operations would be also be complicated, both because of the unit’s massive legal liabilities and the fact that prices of agriculture commodities are slumping.

Nonetheless, pressure is building. Some investors are wondering if Bayer has set aside enough money to resolve the mass US litigation over products it inherited with the $63 billion takeover of Monsanto in 2018, including the weedkiller Roundup and toxic PCBs. Plus, Bayer may struggle to grow its pharma unit through the rest of this decade after stopping a key study over the experimental medicine asundexian.

As a result of these blows, the CEO told investors last week that Bayer has less room for maneuver as he considers a breakup.

Read more: What’s a Spinoff? Why and How Companies Break Up: QuickTake

--With assistance from Tim Loh.

(Updates with Tuesday trading in eighth paragraph.)