Barclays Plc began marketing an additional tier 1 bond, another sign of a revival in a market roiled earlier this year by a historic writedown at Credit Suisse.

The London-based banking company is proposing a benchmark-size dollar perpetual AT1 note in the 10.5% area, according to a person familiar with the matter, who asked not to be identified discussing a private matter. The deal may price as early as later Wednesday.

Last week UBS Group AG sold additional tier 1 notes, its first such issuance since roughly $17 billion of Credit Suisse’s AT1s were wiped out as part of a UBS takeover brokered by the Swiss government. UBS pulled in roughly 10 times the bids for the debt on offer.

The new issuance will bolster Barclays’ AT1 capital structure — an important cushion that helps lenders comply with core capital requirements without relying solely on more expensive equity.

Just like what UBS did, Barclays also included a mechanism that would allow the debt securities to be converted into equity — after a capital adequacy trigger event has occurred — once the existing shareholders agree to the move.

Read: Call Them AT1s or CoCos, Here’s Why They Can Blow Up: QuickTake

This new design sets UBS and Barclays apart from the Credit Suisse AT1 notes that had a complete loss imposed by the Swiss authorities when they engineered the takeover by UBS.

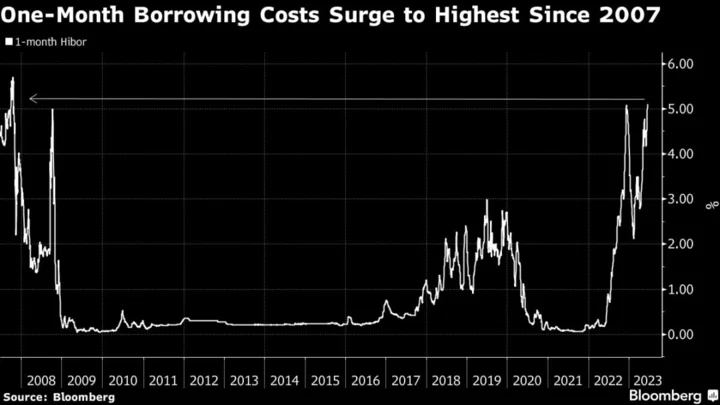

Global contingent convertible bonds from banks have rebounded from their slump in March. Bloomberg Global CoCo Banking Statistics Index has rallied 15% since March 20 and the average yield premium has shrunk 240 basis points since then.

(Updates with more details)