Banks and consumer companies are expected to drive first-quarter earnings in India boosted by accelerating economic activity, easing input costs and decade-low bad loans at lenders, while the outlook for the nation’s software exporters is clouded by global headwinds.

India’s banks have largely remained insulated from a global crisis in the industry with their heavy reliance on local markets. Meanwhile, the nation’s consumer and capital goods companies are expected to benefit from commodity prices that have come off peaks seen after Russia’s invasion of Ukraine.

“Across industries, we’re seeing costs coming off sharply, so that will reflect in earnings,” said Varun Saboo, Mumbai-based head of equities at Anand Rathi Share and Stock Brokers Ltd. Saboo estimates earnings growth in the ballpark of 15% for the companies in the benchmark NSE Nifty 50 index. Asia’s top software services exporter Tata Consultancy Services Ltd. will kick off on Wednesday the first-quarter earnings season for Indian companies.

Conglomerate Reliance Industries Ltd., which has a 10th of the weightage in the Nifty 50 index, would see its operating profit rising in the June quarter, on back of strong performance in its oil-to-chemicals and digital services segments, according to analyst estimates compiled by Bloomberg.

Banking Boom

The bad-loan ratio at Indian banks was at a decade low of 3.9% at the end of March 2023, the Reserve Bank of India said in its Financial Stability Report. It expects the ratio to fall further to 3.6% by March 2024.

Top four private sector lenders in the Nifty 50 index — HDFC Bank, ICICI Bank, Axis Bank and Kotak Mahindra Bank — may see quarterly profits grow between 18% and 38%. Their net interest margins are projected to stay above or around the 4% mark, among the highest in Asia. State Bank of India, the country’s top lender by assets, will see quarterly profit more than double, according to estimates compiled by Bloomberg.

The central bank’s interest rate hikes have also bumped up lending margins at the local lenders. A possible repricing of deposits could shave off some margin, although the impact would be limited until the central bank starts cutting rates.

Rajesh Cheruvu, chief investment officer at Liechtenstein royalty-backed LGT Wealth India, expects net interest margins to shrink by about 30 basis points for the sector until the key rate goes lower, which is not expected at least till September-end, according to a Bloomberg survey. Margin and return on assets remained at levels “too good to be true,” Cheruvu said.

Consumption Drive

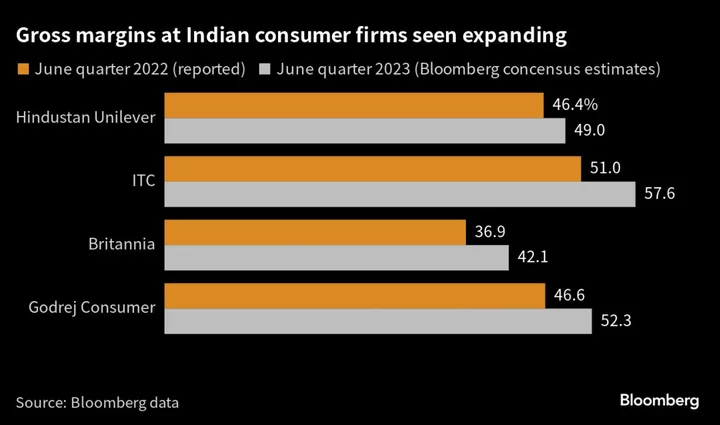

A relief in cost pressures from a fall in energy and material prices coupled with improving supply chains after easing of Covid-related restrictions were likely to help consumer, capital goods and cement companies improve earnings while a takeoff in volumes is expected to sustain.

Lower crude prices would benefit earnings of paint makers, and a drop in palm oil prices would help makers of soaps, detergents and packaged foods, according to Ajay Thakur, a consumer-sector analyst at Anand Rathi.

High retail prices of gasoline and diesel will help margins at refiners, with India’s top three oil marketing companies Indian Oil Corp., Bharat Petroleum Corp. and Hindustan Petroleum Corp. forecast to grow earnings.

Tech Headwinds

A government-brokered bailout of crisis-hit Credit Suisse Group AG by UBS Group AG, and the collapse of two mid-sized US banks earlier this year stoked fears of unrest in the global banking industry, probably forcing many financial firms to cut their discretionary spending on information technology services.

India’s $245 billion technology sector, with a key exposure to banks, might face pressure on pricing, large deals wins and margins. The big four software services exporters — Tata Consultancy Services Ltd., Infosys Ltd., HCL Technologies Ltd. and Wipro Ltd. — get more than a quarter of their revenues from the financial sector.

Increased wages may also chip away at margins, analysts at Jefferies and BNP Paribas wrote in separate notes. But some believe the risks are priced into the valuations. The NSE Nifty IT index currently trades at less than 24 times earnings, down from the record high of about 39 times earnings at the start of 2022.

“It’s been one and a half years of this fear of recession, and fear of cutting spending being talked about in the market,” said Siddarth Bhamre, head of research at Religare Broking Ltd. “For me, IT is available at reasonable valuations.”