A look at the day ahead in European and global markets from Brigid Riley

Markets have a full plate on Wednesday, taking in China's disappointing inflation data while awaiting tomorrow's U.S. CPI report, and processing a surprise banking windfall tax announcement from Italy.

The banking sector in Europe is still reeling after Italy unexpectedly approved a 40% windfall tax, although authorities added in a statement on Tuesday that the new tax could not breach 0.1% of a lender's total assets. European markets will be on guard for similar moves in other countries.

Eyes are turning to the fast-approaching U.S. inflation report after mostly dovish comments from several Fed officials this week. With the next policy meeting not scheduled until September, there's still plenty of time for the U.S. central bank to observe key price data.

The dollar cooled slightly in the Asia morning session, after a boost from safe-haven buying that followed bleak China trade data on Tuesday and Moody's downgrade of several small and mid-sized banks the day before that.

Signs of economic pain continue to emerge in China, leaving local stock markets no time to recover from the disappointing trade numbers before a drop in July's CPI delivered another punch. Pressure is rising on Chinese authorities to step in with fresh stimulus provisions.

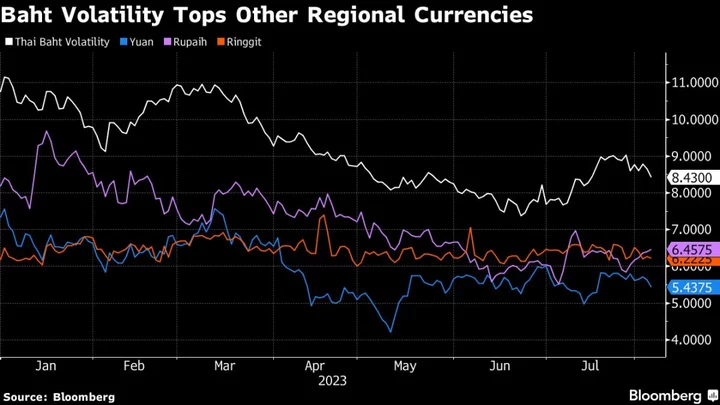

Meanwhile, the yuan appears to have recovered a bit, propped up by Wednesday's stronger-than-expected midpoint fixing from the central bank, after a sharp fall against the dollar in the previous session.

Amid another bustling week of company earnings reports, some extra cheer may soon be in the air from the Magic Kingdoms, with Walt Disney Co expected to post a rise in revenue on Wednesday. Dutch supermarket chain Ahold Delhaize and Germany-based E.ON, Europe's largest energy company, also announce earnings.

Key developments that could influence markets on Wednesday:

- Earnings reports: Ahold Delhaize, E.ON, Illumina, Walt Disney

(Reporting by Brigid Riley; Editing by Edmund Klamann)