The Bank of England is likely to boost interest rates again on Thursday, but a slowing in the pace of inflation may give policymakers scope to scale back the size of hikes.

Economists and investors anticipate the benchmark lending rate will rise at least a quarter-point to 5.25%, with a strong chance of a bigger half-point increase that would match the scale of action taken in June. Markets are now bracing for rates to peak around 5.75% by the end of this year, well below almost a full point below expectations just a month ago.

Stickier price and wage data in the spring cast the UK as an international outlier, leaving the prospect that the BOE will be the last major central bank to complete its hiking cycle. Even so, the latest inflation and unemployment data showed easing pressure on prices that may give the nine-member Monetary Policy Committee leeway to back away from the most aggressive action.

The decision is due at 12 p.m. London time, with a press conference led by Governor Andrew Bailey following a half hour later. Here’s what to watch in the BOE’s decision:

Guidance

The BOE is likely to leave open the possibility of further rate increases as it awaits for confirmation that inflation and the labor market have started to cool.

Economists expect the central bank to leave in place guidance warning that further tightening will be needed “if there were to be evidence of more persistent pressures.” The same guidance has been used at the previous four meetings, and one softer inflation print for June may not be enough to prompt a wholesale shift in communications.

Advisers to Chancellor of the Exchequer Jeremy Hunt are worried about the risk of an overtightening damaging the economy ahead of an election expected next year. Prime Minister Rishi Sunak said on Wednesday that “people can see light at the end of the tunnel” on inflation.

What Bloomberg Economics Says ...

“Our base case is the central bank will raise interest rates by 25 basis points to 5.25%, but another 50-bp hike cannot be ruled out. Looking ahead, we think the stickiness of underlying price pressure will prompt further rate increases in September and November, leaving the terminal rate at 5.75%.”

—Dan Hanson and Ana Andrade, Bloomberg Economics. Click for the PREVIEW.

Vote Split

The loss of the BOE’s chief dove Silvana Tenreyro could nudge the MPC in a more hawkish direction. She’s been replaced by Megan Greene who joined from being chief economist at the Kroll Institute and has already said she would have supported the increase in recent months that Tenreyro had opposed.

Bailey has been even-handed in his recent comments, highlighting both “unacceptably high” inflation and that the full impact of rate hikes has yet to hit. On the hawkish end of the MPC, Catherine Mann is most likely to push for a bigger increase.

“Reacting to just one positive inflation print by hiking only 25 basis points would arguably carry the risk of the MPC being compelled to return to 50 basis points hikes again,” said Anna Titareva, economist at UBS.

Markets

Investors have priced in roughly a one-in-three chance of a half-point hike, suggesting the decision will surprise some participants regardless of what happens.

The pound has strengthened against the dollar and the euro since the last decision, reflecting expectations that rate hikes will continue through the summer. Yields on 10-year gilts are just off their highest level since 2008. A softening in guidance could send market interest rates lower even if the BOE raises its benchmark.

“We expect the BOE to validate much of the increase in market rate expectations but not all, consistent with a terminal rate at around 5.5%-5.75%,” said Robert Wood, chief UK economist at Bank of America.

Mortgages

Thursday’s meeting will also be closely watched by millions of households still yet to be hit by higher mortgage costs. Higher rates usually will lead mortgage rates higher, but in recent weeks some prices on mortgages have fallen as peak-rate bets subsided.

A surge in borrowing costs has strained the ability of people to afford to buy a property or trade up, and house prices are now weakening at their fastest pace in more than a decade. Further increases in lending rates could deepen the slump.

Rates on a two-year fixed deal soared to their highest level in 15 years following the last BOE hike on the expectation of more coming down the track. However, lenders have started to cut mortgage rates again because of a brighter outlook on inflation.

Forecasts

The majority of economists surveyed by Bloomberg expect the BOE to raise its inflation projections for 2023 again despite the glimmer of hope offered by June’s softer-than-expected print.

Headline inflation for June was where the BOE expected at 7.9% but a tight labor market means services inflation — a gauge of domestic price pressures — and wage growth are running hotter than expected. Economists say it is touch and go whether Sunak meets his pledge to halve inflation this year.

At 2 p.m., the BOE will release figures from its decision maker panel survey, which assesses inflation expectations held by company executives. That could color how the MPC thinks about the persistence of inflation.

On growth, Bloomberg Economics expects that the BOE will predict “a protracted period of stagnation,” but stop short of putting a recession back into its forecast.

Quantitative Tightening

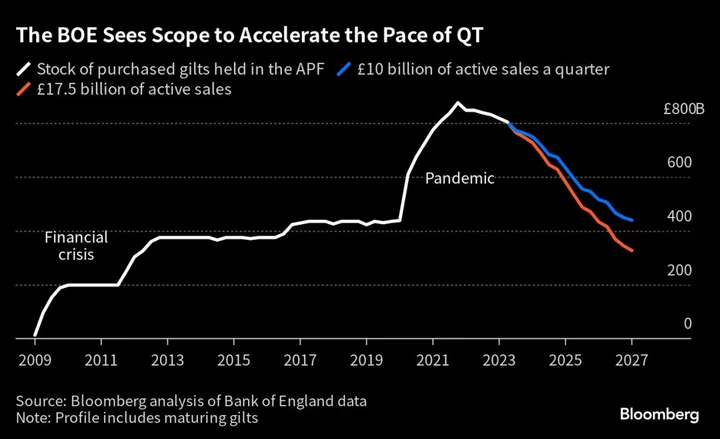

The MPC could also announce plans to accelerate the reduction of its balance sheet of bonds accumulated during more than a decade of stimulus under the quantitative easing program.

The BOE, which built up a portfolio of £895 billion ($1.1 trillion) of bonds at the peak of the program. It’s now selling off the debt or allowing assets to mature at the pace of £80 billion a year, incurring losses that the Treasury must finance. The BOE estimates the program may cost taxpayers at least £100 billion.

Dave Ramsden, deputy governor for markets and banking, has already indicated that the BOE is likely to up the pace in the second year after judging that it has had little impact on gilt yields.

Economists expect this to be lifted to at least £90 billion and possibly even higher from October.

Read more:

- SURVEY: BOE to Raise Rates to 5.25% in August, Keep QT Pace

- BOE Warns Taxpayer Faces £100 billion Net Losses on QE Program

- Whipsawed UK Traders Get No Rest With Rates Unclear

- Traders on Alert for BOE to Hint at Faster Pace of Bond Sales

- UK’s War on Inflation Is Hitting Families and Renters Hardest

- Treasury Advisers Worry BOE Risks Overdoing Inflation Battle

- BOE Gilt Sales Are a Multibillion-Pound Error: Marcus Ashworth

--With assistance from Harumi Ichikura and Andrew Atkinson.