Australia’s inflation accelerated faster than expected in April driven by higher fuel and housing prices, snapping three months of cooling and boosting the chance of another interest-rate increase next week.

Consumer prices advanced 6.8% from a year earlier, up from 6.3% in March and exceeding a forecast 6.4% gain, official data showed Wednesday. The figures came shortly after Reserve Bank Governor Philip Lowe left the door ajar for further hikes, restating his resolve to bring inflation back to the 2-3% target.

RBA Is in ‘Data-Dependent Mode’ on Interest Rates, Governor Says

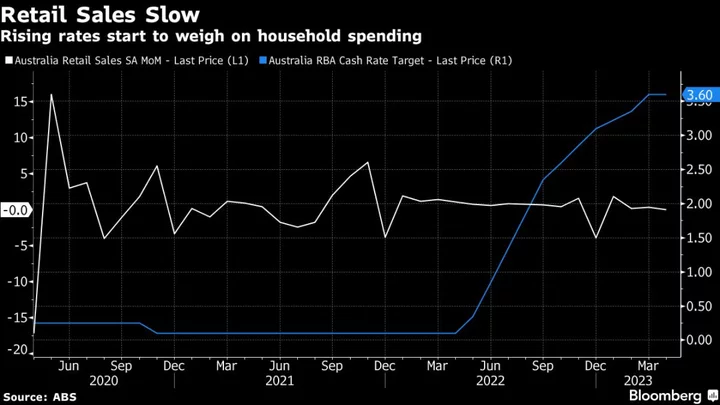

The result casts some doubt over widespread expectations that the RBA would pause at Tuesday’s meeting, prompting overnight-indexed swaps to now fully price in a 25 basis-point hike by August, from 21 basis point before the data, while stocks extended declines.

Some economists including Goldman Sachs Group Inc. revised their rate forecast after the data to predict a quarter-percentage-point hike next week.

“We view the composition as strong overall given an acceleration in inflation momentum across rents, new housing and several durable goods items,” Goldman economists led by Andrew Boak said in a research note. “Following today’s data we now expect the RBA to hike 25-basis-points in June and July to a terminal rate of 4.35%.”

Goldman had previously forecast a peak of 4.1%. Capital Economics is also calling a rate hike at Tuesday’s meeting. Adelaide Timbrell at ANZ Group Holdings Ltd. said the data tilts the risk toward “earlier and/or more action from the RBA” while Citigroup Inc. says the June meeting is now “live.”

Wednesday’s report complicates the task for Lowe, who described the RBA as being in “data-dependent mode” following 11 rate hikes since May 2022 that have taken policy to a level he views as “restrictive.”

The RBA has raised rates by 3.75 percentage points over the past year to take the cash rate to an 11-year-high of 3.85%. That has driven a slowdown in consumer spending and employment growth, while business surveys are pointing to weaker conditions.

Ahead of first-quarter gross domestic product data on June 7, some economists are forecasting a negative number. Still, Lowe insisted today that the RBA remains on its “narrow path” of bringing inflation back to target while delivering a soft landing for the economy.

“The RBA still has a clear bias to tighten,” said Stephen Cooper, who oversees A$10 billion in Australian and New Zealand fixed income assets at First Sentier Investors in Sydney. “Pricing one hike in is reasonable given where the inflation prints are.”

Wednesday’s report was impacted by the end of a temporary government fuel subsidy, said Michelle Marquardt, ABS head of prices statistics. Other significant contributors were housing, up 8.9%, food and non-alcoholic beverages, rising 7.9%, and transport, gaining 7.1%.

After excluding volatile items such as fruit, vegetables, fuel and holiday travel, underlying price growth was 6.5% in April, easing from 6.9% in March.

What Bloomberg Economics Says...

“The surprisingly steep rise in April’s inflation rate was driven by fuel-price distortions that masked cooling consumer price pressures more broadly. Lingering inflationary pressure in rents and electricity prices are a concern. But we think the RBA will place more weight on recent evidence the economy is sagging under the weight of 375 basis points of rate hikes since May 2022”

— James McIntyre, Economist.

To read the full note, click here

Prior to the data release, Governor Lowe said one of the reasons for his policy tightening bias was to reinforce the idea that “we’ll do what’s necessary to get inflation to come down.”

“We really want people to understand that we are serious about this, that we’ll do what’s necessary, not to question our commitment to getting inflation back down,” Lowe told senators at Parliament House in Canberra. “As painful as that is we’ve got work to do there.”

--With assistance from Matthew Burgess and Georgina McKay.

(Adds Goldman Sachs’ change of rate call.)