Australia’s central bank surprised investors for a second straight month with an interest-rate increase that suggested it’s worried about inflation expectations becoming unmoored if policy isn’t tightened further.

The Reserve Bank also signaled that further rate hikes “may be required” even as money markets are still refraining from fully pricing in another adjustment. While many economists predict one more increase to 4.35%, others see the RBA as done and instead expect that rates will need to remain higher for longer.

The following charts show why the RBA has turned hawkish since a pause in April, even as jobs growth eases and consumer spending cools.

The RBA appears worried about whether it can meet its forecast for inflation to return to the top of its 2-3% target by mid-2025 without further tightening. Governor Philip Lowe went so far as to omit from Tuesday’s statement his long-held view that “medium-term inflation expectations remain well anchored.”

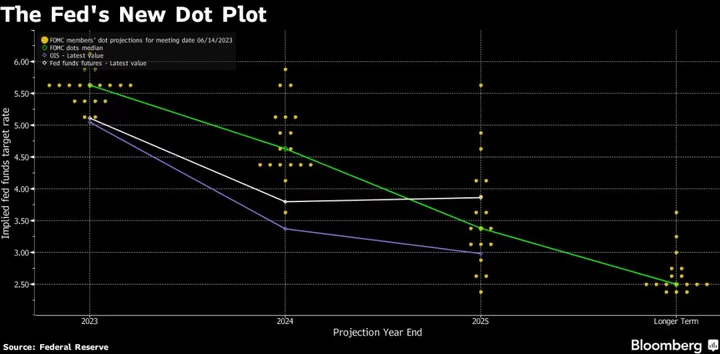

That chimes with similar concerns among Federal Reserve policy makers that rate hikes to date haven’t done enough to tamp down price pressures.

Su-Lin Ong at Royal Bank of Canada reckons the RBA’s confidence in returning price growth to target within a reasonable time-frame has “faltered,” adding its policy rate remains “some way below its dollar bloc counterparts even” although key drivers of inflation are not “particularly different.”

“Today’s stronger language around the labor market, wages and inflation suggests that the decision was, perhaps, not as close as the last two meetings,” she added.

Another major factor for the hawkish tilt is strong wage demand from labor unions, with the RBA highlighting that unit labor costs are rising “briskly with productivity growth remaining subdued.”

Australia’s industrial relations umpire last week increased the minimum wage, covering around a fifth of the country’s workforce, by 5.75%. The RBA clearly acknowledged the risk from that decision by noting that “the annual increase in award wages was higher than it was last year.”

State government are also ratcheting up the wages of low paid workers in their jurisdictions. Without productivity growth, which has stalled in recent years, such strong increases will not be consistent with the 2-3% inflation target.

The government reports gross domestic product growth in the January-March period Wednesday morning, hours after Lowe gives his post-rate remarks in Sydney.

House prices, which had been falling and weighing on consumer sentiment, have reversed course rapidly, turning from headwind to tailwind. In May, they climbed for a third straight month with agents saying buyer demand has been surprisingly strong.

Higher house prices “suggest that financial conditions need to tighten further,” said Josh Williamson, an economist at Citigroup Inc. who upgraded his terminal rate forecast after Tuesday’s decision to 4.6%, from 4.35% previously.