LAS VEGAS--(BUSINESS WIRE)--Oct 11, 2023--

The Association of Independent Mortgage Experts (AIME) is thrilled to announce the resounding success of its sixth annual national conference, Fuse, which brought together thousands of independent mortgage brokers, industry leaders, and experts from across the nation, despite the current state of the housing market. This year's event, held at The Paris Hotel and Casino in Las Vegas, had 2,700 registered attendees and showcased the continued growth and innovation within the independent mortgage broker community.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231011802273/en/

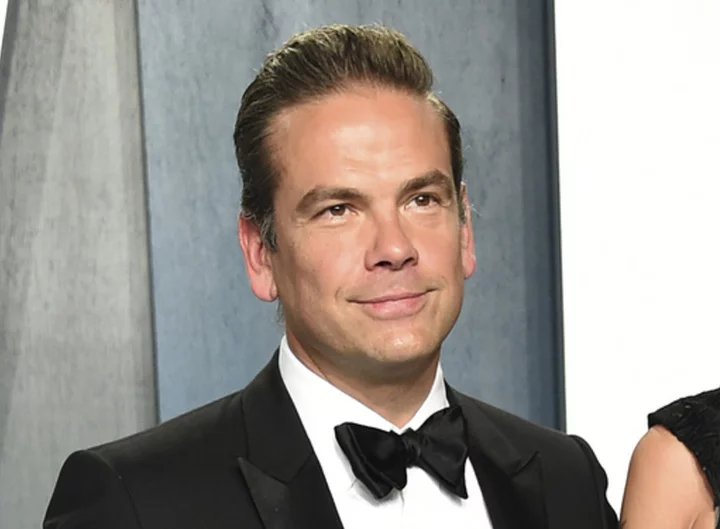

Katie Sweeney, AIME Chairman and CEO, on stage at the sixth annual Fuse national conference in Las Vegas for independent mortgage brokers. (Photo: Business Wire)

AIME Chairman and CEO Katie Sweeney took the stage to share compelling data that unequivocally demonstrates that independent mortgage brokers are the more cost-effective choice for borrowers. With data analyzed by Polygon Research drawing upon insights from HMDA, Fannie Mae, Freddie Mac, and Ginnie Mae, Sweeney reinforced the value proposition of independent brokers, emphasizing that they offer borrowers a more affordable path to homeownership compared to other mortgage origination channels.

“The broker channel is not only the superior channel for many originators, but it is also the definitively better option for American consumers. We're cheaper overall, saving the average borrower $13,809," Sweeney explains. "And while there is still much progress to be made, we're seeing big strides specific to underserved communities. The broker-share of originations in minority-populated markets is up by 100% since 2018 – and the trend is heading in only one direction.”

Sweeney further detailed the success of the association over the past 18 months, with highlights including:

- Raising over $1.5 million for broker advocacy

- Appointing almost 100 State Captains representing 45 states

- Saving members roughly $1.75 billion since the launch of AIME’s Escalation program

- Educating over 25,000 brokers and borrowers with trainings and informative resources

- Reaching 15,000 college students and Retail loan originators with wholesale career education

- Awarding 300 grants to new Broker Owners in the wholesale channel

Among the many highlights of Fuse 2023 were the distinguished speakers who graced the stage, providing invaluable insights and inspiration to attendees. AIME was honored to host industry visionaries and thought leaders, including Mat Ishbia, President and CEO of United Wholesale Mortgage; Doug Duncan, Chief Economist of Fannie Mae; René Rodriguez, Best-Selling Author; Dale Vermillion, Founder and CEO of Mortgage Champions; Todd Duncan, Founder and CEO of The Todd Duncan Group, and Chris Vinson, CEO of Windsor Mortgage. These speakers captivated the audience with their expertise, sparking engaging conversations and fostering collaboration within the mortgage industry, particularly focusing on ways to adapt to today’s challenging market.

During Fuse, Mat Ishbia, President and CEO of UWM, the #1 mortgage lender in the country and AIME Title Sponsor, unveiled Memory Maker, a new tool that allows independent mortgage brokers to send their choice of thank you items to borrowers and real estate agents, including personalized emails and handwritten notes or gifts for borrowers, such as a cutting board or welcome mat. Brokers can choose which thank you item they’d like to send and when they’d like it sent, and UWM will handle the rest. Ishbia also announced significant enhancements to UWM’s exclusive PA+ service, which now allows brokers and their processors to choose which part of the loan process they’d like a UWM Loan Coordinator to handle when they need additional help with Setup, Underwriting or Closing, or they can opt for Full Service for support from Setup through Closing. These tools are just the latest examples of UWM’s commitment to support independent mortgage brokers with industry-leading training, technology and service.

Additionally, attendees had the privilege of hearing Doug Duncan, Fannie Mae's Chief Economist, deliver his highly anticipated forecast for the future of the housing market. Duncan's insights shed light on critical market trends and provided attendees with valuable knowledge to navigate the ever-evolving mortgage landscape.

Fuse VI also held its fourth annual Women’s Mortgage Network Summit and second annual Diversity and VA Summits. During the Diversity Summit, Floify announced a groundbreaking integration that will help more consumers from underserved communities become homeowners. Floify’s new integration will use a 12-month VOA to verify on-time rental payments, which will help strengthen the credit file and improve the chances of an AUS approval for those with limited credit histories. This is the second step of an important change from Fannie Mae that the industry had struggled to implement effectively until now.

This year’s conference also held the first-ever Advocacy Golf Fundraiser at the Bali Hai Golf Course, with proceeds raised to support AIME’s legislative efforts. Golfers spent the day prior to the start of the multi-day conference, learning more about the association’s advocacy efforts and networking with other mortgage brokers and partners on the golf course.

“It truly uplifted my spirits to witness the positive attitude of every attendee. I expected some apprehension given the market conditions, but it was nowhere to be seen,” states Tom Ahles, AIME’s President of Growth. “Attendees were present, excited, and ready to get better – and they will make up the backbone of our community for years to come.”

About the Association of Independent Mortgage Experts

The Association of Independent Mortgage Experts (AIME) is a non-profit, national trade membership association created exclusively for independent mortgage brokers. With over 65,000 members, AIME is committed to establishing a community of independent mortgage experts by creating an association that empowers them with unparalleled technology, continued education, broker advocacy, and networking support necessary to successfully advise consumers nationwide with their residential mortgage needs. AIME operates with a growth-focused strategy, providing tools and resources to propel the wholesale channel beyond a 25% share of the mortgage market in 2023 and to a majority of the market within the next decade.

View source version on businesswire.com:https://www.businesswire.com/news/home/20231011802273/en/

CONTACT: Media:

Jennifer Leonard

VP, Marketing

communications@aimegroup.com

KEYWORD: UNITED STATES NORTH AMERICA NEVADA

INDUSTRY KEYWORD: BANKING PROFESSIONAL SERVICES TRAINING CONSUMER TECHNOLOGY RESIDENTIAL BUILDING & REAL ESTATE SMALL BUSINESS CONSTRUCTION & PROPERTY EDUCATION OTHER CONSUMER FINANCE OTHER TECHNOLOGY

SOURCE: The Association of Independent Mortgage Experts

Copyright Business Wire 2023.

PUB: 10/11/2023 03:53 PM/DISC: 10/11/2023 03:52 PM

http://www.businesswire.com/news/home/20231011802273/en