Asian equities were set to fall on Monday after shares on Wall Street capped off a poor week on a down note and as China’s worsening property slump damps market sentiment.

Futures for stocks in Australia, Japan and Hong Kong all pointed lower, as did a gauge of US-listed Chinese companies. Country Garden Holdings Co., once China’s largest private-sector developer by sales, is at risk of joining a slew of defaulters and the latest economic data for the nation is likely to show little sign of a rebound in growth.

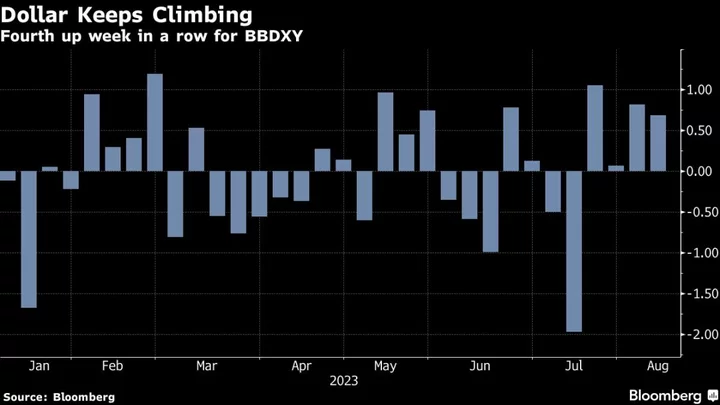

Meanwhile in Japan, the yen is trading near the closely watched 145 level versus the dollar amid depreciation pressure that has investors on watch for any signs the government may intervene as it did last year. The currency weakened for five straight days through Friday while an index of dollar strength has advanced over the last four weeks with elevated Treasury yields.

Friday’s US trading session saw a slide in tech megacaps and mixed economic data leave stocks weak and struggling for direction. In choppy trading, the S&P 500 closed at a one-month low with a drop of just 0.1%. The Nasdaq 100 notched its longest weekly losing streak this year, hovering around 15,000. Nvidia Corp. — which has more than tripled in 2023 — extended a four-day decline to 10%.

Bill Gross, the one-time bond king, said stock and Treasury bulls are wrong as both markets are “overvalued.”

The former chief investment officer of Pacific Investment Management Co. told Bloomberg Television that the fair value of the 10-year Treasury yield is about 4.5%, compared with the current level of 4.15%.

Meantime, Friday’s economic reports did little to alter swap market bets that the Federal Reserve will pause its rate hikes next month. Traders also continued to expect the central bank to signal its battle against inflation isn’t over yet.

Consumer inflation expectations as measured by the University of Michigan unexpectedly fell in early August, despite higher gasoline and grocery costs. Meantime, producer prices grew last month by more than expected, primarily due to increases in certain service categories.

Oil dlipped Monday after posting its longest streak of weekly gains since mid-2022. Multiple reports forecasting increased demand gave a fresh boost to a rally built on increased supply-disruption risks and extended Saudi production cuts.

Key events this week:

- China medium-term lending, retail sales, industrial production, fixed-asset investment, FX net settlement, Tuesday

- Japan industrial production, GDP, Tuesday

- UK jobless claims, unemployment, Tuesday

- US retail sales, empire manufacturing, business inventories, cross-border investment, Tuesday

- Reserve Bank of Australia policy minutes, Tuesday

- Federal Reserve Bank of Minneapolis President Neel Kashkari speaks, Tuesday

- China property prices, Wednesday

- Eurozone industrial production, GDP, Wednesday

- UK CPI, Wednesday

- US FOMC minutes, housing starts, industrial production, Wednesday

- US initial jobless claims, US Conf. Board leading index, Thursday

- Eurozone CPI, Friday

- Japan CPI, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.2% as of 8:05 a.m. Tokyo time. The S&P 500 fell 0.1% Friday

- Nasdaq 100 futures rose 0.2%. The Nasdaq 100 fell 0.7%

- Nikkei 225 futures fell 0.4%

- Australia’s S&P/ASX 200 Index futures fell 0.4%

- Hang Seng Index futures fell 1.2%

Currencies

- The Bloomberg Dollar Spot Index was unchanged

- The euro was little changed at $1.0942

- The Japanese yen was little changed at 144.92 per dollar

- The offshore yuan was little changed at 7.2602 per dollar

- The Australian dollar was little changed at $0.6495

Cryptocurrencies

- Bitcoin fell 0.3% to $29,309.26

- Ether fell 0.8% to $1,837.78

Bonds

- The yield on 10-year Treasuries advanced five basis points to 4.15% Friday

- Australia’s 10-year yield advanced eight basis points to 4.19%

Commodities

- West Texas Intermediate crude fell 0.5% to $82.75 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.