Asian equities looked poised for mixed open Tuesday after US stocks pulled back short of entering a bull market while the dollar was steady and Treasury yields ended mostly little changed.

Japanese and Australian stock futures pointed to marginal losses while those for Hong Kong suggested small gains. Tech shares led the S&P 500 down, with Apple Inc. wiping out gains of as much as 2% in anticipation of a new mixed-reality headset.

The 10-year Treasury yield closed flat while shorter-end yields inched down after a report said the US services sector nearly stagnated in May, giving traders pause to rethink the Federal Reserve’s interest-rate hike path.

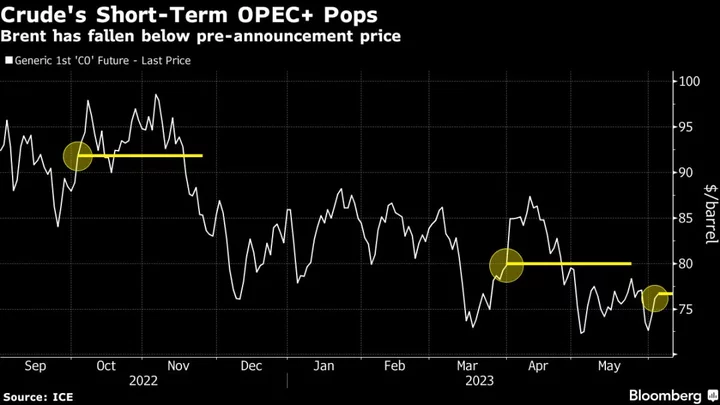

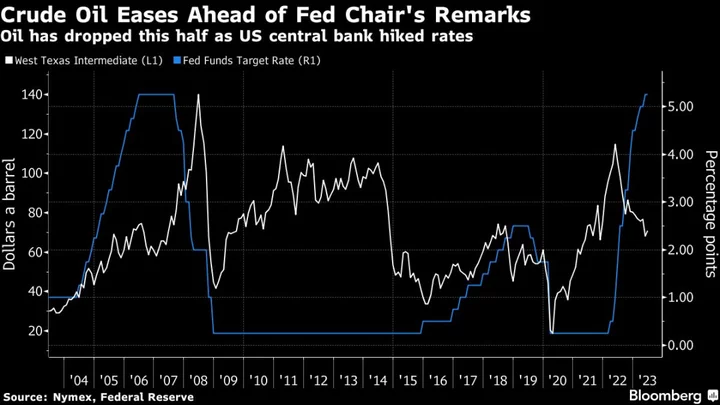

Oil majors Chevron Corp. and Exxon Mobil Corp. also slipped after rallying earlier on higher oil prices following a Saudi Arabia supply cut. Still, the fuel dipped in early trading Tuesday as the advance of recent days in both the West Texas Intermediate and Brent benchmarks looked at risk of running out steam.

Speculation that the Fed may plan to keep rates steady in June but keep options open for later hikes ramped up after the Institute for Supply Management’s overall gauge of services unexpectedly fell to the lowest level of the year, offering a less upbeat assessment of the US economy.

Australian government bond yields fell slightly and the currency held a small overnight gain ahead of the central bank’s interest rate decision later Tuesday, with the consensus view for policymakers to stand pat.

Traders in Asia will also be watching the release of consumer price index data in the Philippines, Thailand and Taiwan for fresh indications of the impact of the global inflationary cycle.

Saira Malik, chief investment officer at Nuveen, said she foresees a mild US recession sometime in 2024 as the “growth-dampening effects of tight monetary policy work their way through the economy.”

“With high inflation likely to persist, we think investors would be well-served by allocating to real assets that can provide meaningful inflation protection,” she said, pointing to farmland.

In other news, Bitcoin fell after Binance Holdings Ltd. and its chief executive officer were accused of breaking US securities rules. And US regulators revoked emergency authorization for Johnson & Johnson’s Covid-19 vaccine after the company’s Janssen unit requested its withdrawal.

Elsewhere, gold was steady on Tuesday after advancing 0.7% in the previous session.

Key events this week:

- Rate decisions in Australia, Poland, Tuesday

- China forex reserves, trade, Wednesday

- US trade, consumer credit, Wednesday

- Canada rate decision, Wednesday

- EIA crude oil inventory data, Wednesday

- Eurozone GDP, Thursday

- Rate decisions in India, Peru, Thursday

- Japan GDP, Thursday

- US wholesale inventories, initial jobless claims, Thursday

- China PPI, CPI, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were down 0.1% as of 8:23 a.m. Tokyo time. The S&P 500 fell 0.2% Monday

- Nasdaq 100 futures fell 0.1%. The Nasdaq 100 was little changed

- Nikkei 225 futures fell 0.4%

- Australia’s S&P/ASX 200 Index futures fell 0.6%

- Hang Seng Index futures rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0708

- The Japanese yen rose 0.1% to 139.43 per dollar

- The offshore yuan was little changed at 7.1212 per dollar

- The Australian dollar was unchanged at $0.6617

Cryptocurrencies

- Bitcoin rose 0.6% to $25,794.78

- Ether rose 0.5% to $1,813.63

Bonds

- The yield on 10-year Treasuries was little changed at 3.68% Monday

- Australia’s 10-year yield declined one basis point to 3.77%

Commodities

- West Texas Intermediate crude fell 0.3% to $71.90 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Isabelle Lee and Vildana Hajric.