Asian stock futures fell after Wall Street closed lower as investors looked beyond the debt ceiling to instead focus on the path for interest rates and concern in earnings reports.

Contracts for benchmarks in Japan, Hong Kong and Australia all slid, adding pressure to the region’s equities, which fell more than 1% Wednesday against the backdrop of worries about Chinese growth. Manufacturing data for China due Thursday is forecast to show a further contraction in activity.

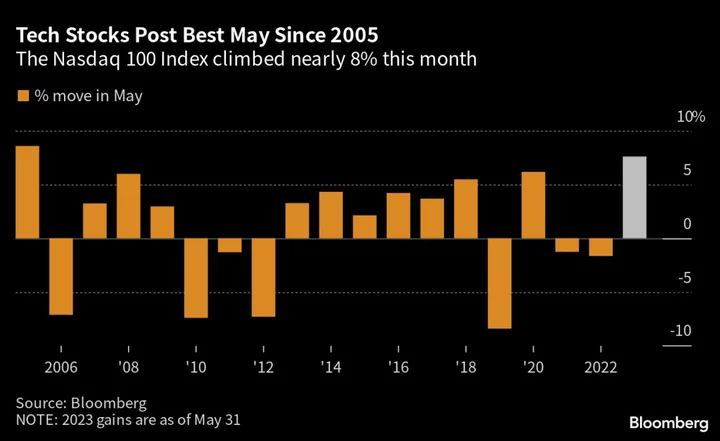

Contracts for US equities were flat in early Asian trading after declines on Wednesday. The S&P 500 closed 0.6% lower, narrowly clinging to a small gain for May to mark three consecutive monthly advances. The Nasdaq 100 index fell 0.7%, weighed down by a decline for Nvidia Corp. shares after a rapid rally that has tripled the stock price this year.

Australian and New Zealand bond yields inched lower, following a decline in Treasury yields and a rally in the dollar.

Those moves followed comments from Federal Reserve Governor Philip Jefferson, who signaled the central bank is inclined to keep interest rates steady in June to assess the economic outlook. His remarks were echoed by Philadelphia Fed President Patrick Harker, who said: “I think we can take a bit of a skip for a meeting.”

Hopes for a Fed pause were partly pared back after the JOLTS jobs report for April showed more than 10 million openings, the highest in three months and above consensus estimates.

Traders also watched the latest developments in the US debt-ceiling saga. The deal struck by House Speaker Kevin McCarthy and President Joe Biden cleared a major hurdle in the House, lining the compromise legislation up for passage as the US quickly approaches a June 5 deadline to avert a default.

“Those planning for a relief rally following the passage of the debt ceiling increase may be disappointed,” said Mark Hackett, chief of investment research at Nationwide. “The next move higher for equities will require improving data and a shift in investor confidence.”

Corporate earnings were again in focus. Shares in Salesforce Inc. tumbled around 7% in afterhours trading following a dim outlook for sales while Hewlett Packard Enterprise Co. fell 7.1% Wednesday on slimmer revenue projections than anticipated.

Elsewhere, West Texas Intermediate crude deepened its slide below $70 a barrel. ICE Brent futures were also lower.

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 8:24 a.m. Tokyo time. The S&P 500 fell 0.6%

- Nasday 100 futures were little changed. The Nasdaq 100 fell 0.7%

- Hang Seng futures fell 0.2%

- S&P/ASX 200 futures fell 0.2%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0695

- The Japanese yen rose 0.2% to 139.04 per dollar

- The offshore yuan was little changed at 7.1164 per dollar

- The Australian dollar was little changed at $0.6509

- The British pound was little changed at $1.2448

Cryptocurrencies

- Bitcoin rose 0.2% to $27,173.76

- Ether rose 0.2% to $1,869.95

Bonds

- The yield on 10-year Treasuries declined four basis points to 3.64%

- Japan’s 10-year yield was unchanged at 0.430%

- Australia’s 10-year yield declined two basis points to 3.59%

Commodities

- West Texas Intermediate crude fell 0.6% to $67.67 a barrel

- Spot gold rose 0.2% to $1,966.31 an ounce

This story was produced with the assistance of Bloomberg Automation.