Asian stocks advanced Tuesday, buoyed by Wall Street gains, as US shares extended their storming rally and a $16 billion sale of 20-year Treasuries lured bond buyers.

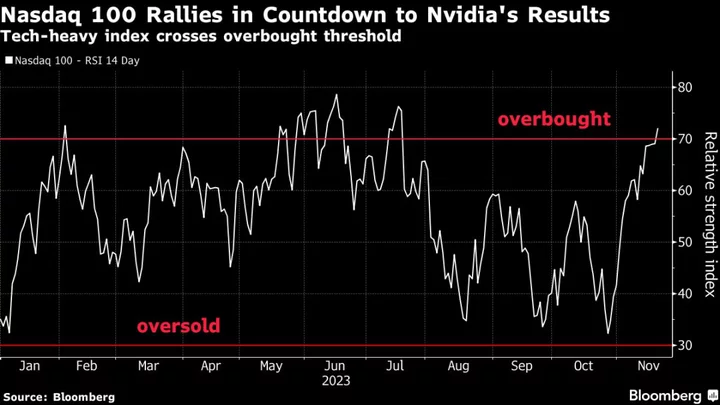

Technology stocks were among the outperformers, with also South Korean and Australian benchmarks inching higher. Futures for Hong Kong pointed to a solid start as the Golden Dragon index of US-listed Chinese companies supported sentiment with more than 3.5% in gains. US contracts steadied after the S&P 500 had its strongest close since August and the Nasdaq 100 hit a 22-month high.

“We remain positive on equities and expect a broadening of the rallies recently experienced as the US economy continues on a sustainable economic expansion albeit at a modest pace,” said John Stoltzfus, chief investment strategist at Oppenheimer Asset Management.

Treasuries held their gains in early Asia trading following a strong 20-year auction in the previous session. Shortly after the auction results, US 10-year yields reversed course and fell to around 4.4% Monday, pushing the dollar to an 11-week low. The greenback was little changed Tuesday and remained weaker against most of its major peers.

In Asia, nervousness lingers over the strength of China’s economic recovery, and particularly for its struggling property sector. China Vanke Co., Seazen Group Ltd. and Longfor Group Holdings Ltd. are among a list of about 50 developers that may be eligible for support from bank loans, debt and equity financing, Bloomberg reported.

More clues of recovery in China may come from Baidu Inc. as well as Kuaishou Technology that are in the pipeline to report results Tuesday. Baidu will probably report a 5.1% increase in revenue, estimates show, while Kuaishou may report little-changed earnings sequentially as improvements in content algorithms and e-commerce sales were offset by weaker live-streaming revenue.

In the artificial intelligence sector, OpenAI’s investors are still trying to return co-founder Sam Altman to a leadership role at the ChatGPT maker. Earlier, Microsoft Corp. climbed to fresh peaks after it hired Altman and Greg Brockman to lead its research team. In late US trading, Zoom Video Communications Inc. rose on better-than-expected sales, while Nvidia Corp. will report quarterly results Tuesday.

Elsewhere in currencies, the Australian dollar strengthened after the nation’s central bank said in meeting minutes it expects inflation will only return to the top of its 2-3% target in late 2025.

Attractive Yields

Traders have also been fixated on Treasury sales, especially after the US recently offered an unusually large premium to sell 30-year securities. Those auctions have been exerting a growing sway over stocks, underscoring how the path of interest rates is gripping markets of late. The 20-year bond auction drew yields of 4.78%, compared with the pre-sale level of 4.79%.

After a more than three-decade hiatus, the Treasury resurrected 20-year bonds in May 2020. Before Monday’s auction, it had not sold the securities during the Thanksgiving week. They’ve traded at a discount to other long-term maturities — which caused a degree of apprehension ahead of the sale.

“Treasuries offer extremely attractive yields,” according to Principal Asset Management. “And while the potential for capital appreciation might be limited in the face of an impending economic slowdown, the assurance of a steady income from Treasuries makes them a solid option for investors prioritizing stability heading into an uncertain 2024.”

Meanwhile, the S&P 500 is set to rise toward its all-time high early next year, pullback midyear and then rally back toward the highs, according to strategists at Societe Generale SA.

“The S&P 500 should be in ‘buy-the-dip’ territory, as leading indicators for profits continue to improve,” wrote Manish Kabra. “Yet, the journey to the end of the year should be far from smooth” he added, citing an economic downturn, a looming credit selloff, and ongoing quantitative tightening as hurdles traders still need to face.

Elsewhere, oil held a two-day rise amid speculation that OPEC+ could deepen production curbs when members gather this coming weekend.

Key events this week:

- ECB President Christine Lagarde and German Finance Minister Christian Lindner speak, Tuesday

- US existing home sales, Tuesday

- FOMC issues minutes from the Nov. 1 policy meeting, Tuesday

- Nvidia’s earnings, Tuesday

- Canada’s update to the government’s fiscal and economic outlook, Tuesday

- Eurozone consumer confidence, Wednesday

- US initial jobless claims, University of Michigan consumer sentiment, durable goods, Wednesday

- Bank of Canada Governor Tiff Macklem speaks, Wednesday

- Eurozone S&P Global Manufacturing & Services PMI, Thursday

- Thanksgiving holiday — US markets closed — Thursday

- ECB publishes account of October policy meeting, Thursday

- Germany IFO business climate, Friday

- US S&P Global Manufacturing PMI, Friday

- Black Friday, traditional kick-off for the US holiday shopping season

- ECB’s Christine Lagarde speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 9:32 a.m. Tokyo time. The S&P 500 rose 0.7%

- Nasdaq 100 futures rose 0.1%. The Nasdaq 100 rose 1.2%

- Hang Seng futures rose 1%

- Japan’s Topix fell 0.4%

- Australia’s S&P/ASX 200 rose 0.2%

- Euro Stoxx 50 futures rose 0.1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0944

- The Japanese yen was little changed at 148.35 per dollar

- The offshore yuan was little changed at 7.1604 per dollar

- The Australian dollar was little changed at $0.6563

Cryptocurrencies

- Bitcoin rose 0.3% to $37,535.12

- Ether rose 0.2% to $2,029.88

Bonds

- The yield on 10-year Treasuries declined one basis point to 4.41%

- Australia’s 10-year yield declined four basis points to 4.47%

Commodities

- West Texas Intermediate crude fell 0.3% to $77.62 a barrel

- Spot gold rose 0.2% to $1,982.93 an ounce

This story was produced with the assistance of Bloomberg Automation.