Asian stocks slipped following US peers lower, driven by the continued sell-off in Treasuries and increasing tensions in the Middle East.

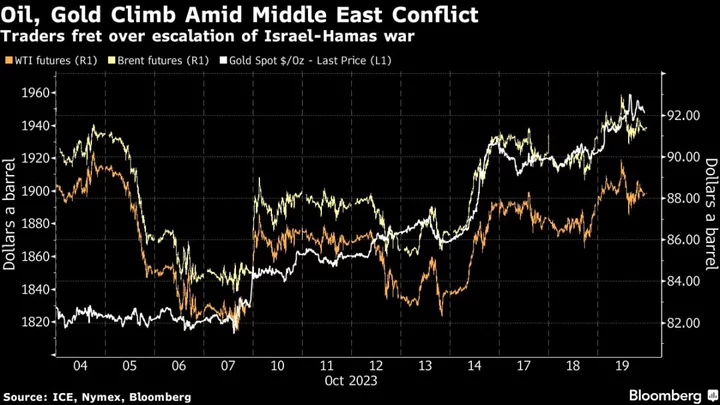

Australian, Japanese and South Korean shares all fell over 1% in early trading while futures in Hong Kong also pointed to losses. Oil edged lower after rallying in its previous session with the US suspending some sanctions on Venezuelan output while gold extended gains amid demand for safe-haven assets. The precious metal has now risen over 4% in the last five days.

Australian and New Zealand bond yields surged while their US counterparts steadied in Asia trading following Wednesday’s gain. Fed Bank of New York President John Williams said interest rates will have to stay at restrictive levels “for some time” to bring inflation back to the central bank’s target.

In currencies, the yen slightly strengthened as Japan’s exports rose more than expected in September. Traders are preparing for turbulent trading in the currency amid growing concerns that Japanese authorities will intervene. Elsewhere, the Malaysian ringgit fell to a 25-year low weighed partly by the dollar’s recent gains. The greenback traded flat Thursday, after gaining over the last two sessions.

Oil’s rally came as Iran intensified its rhetoric against Israel after an explosion at a Gaza hospital that complicated diplomatic efforts to rein in the Middle East conflict. United Airlines Holdings Inc. tumbled almost 10% after warning the Israel-Hamas war and higher jet fuel costs would weigh on earnings. UK Prime Minister Rishi Sunak is set to visit Israel on Thursday.

“The risks of an escalation have risen on the back of the latest news reports regarding the hospital bombing,” said Jane Foley, head of foreign-exchange strategy at Rabobank. While there have been few signs of panic, “on any clear escalation, we can expect to see a ratcheting up of risk aversion,” she said.

Contracts for US equities traded within narrow ranges in Asia after the S&P 500 slumped 1.3% on Wednesday. Morgan Stanley sank the most since 2020 as profit fell on an investment-bank slowdown while Netflix rallied post-market after strong earnings.

Treasury yields remain at multi-decade highs with Fed Governor Christopher Waller noting policymakers can wait and gather more data before deciding if the economy needs further monetary restraint.

“A reiteration of the ‘higher for longer’ message on interest rates may allow US yields to stay at or above their current levels and keep the dollar supported,” said Carol Kong, a strategist at Commonwealth Bank of Australia.

Still, elevated yields are attracting buyers, with a 20-year auction seeing its yield lower than indicated pre-auction trading, helping cap a rise in long-dated yields. Fed Chair Jerome Powell is set to speak at the Economic Club of New York on Thursday.

In Asia, investors will be monitoring distressed Chinese builder Country Garden Holdings Co., which is set for a first-ever default as a grace period ends for dollar-bond interest.

Key events this week:

- Australia unemployment, Thursday

- Japan trade, Thursday

- China property prices, Thursday

- US initial jobless claims, existing home sales, leading index, Thursday

- Federal Reserve Chair Jerome Powell, Chicago Fed President Austan Goolsbee, Atlanta Fed President Raphael Bostic, Philadelphia Fed President Patrick Harker, Dallas Fed President Lorie Logan speak at different events, Thursday

- Japan CPI, Friday

- China loan prime rates, Friday

- Philadelphia Fed President Patrick Harker speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 9:27 a.m. Tokyo time. The S&P 500 fell 1.3%

- Nasdaq 100 futures were little changed. The Nasdaq 100 fell 1.4%

- Hang Seng futures fell 1.1%

- Japan’s Topix fell 0.9%

- Australia’s S&P/ASX 200 fell 1.4%

- Euro Stoxx 50 futures fell 1.1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0534

- The Japanese yen rose 0.1% to 149.77 per dollar

- The offshore yuan was little changed at 7.3287 per dollar

- The Australian dollar fell 0.2% to $0.6324

Cryptocurrencies

- Bitcoin rose 0.4% to $28,359

- Ether rose 0.2% to $1,565.95

Bonds

- The yield on 10-year Treasuries advanced one basis point to 4.93%

- Japan’s 10-year yield advanced 1.5 basis points to 0.820%

- Australia’s 10-year yield advanced 11 basis points to 4.76%

Commodities

- West Texas Intermediate crude fell 0.4% to $88 a barrel

- Spot gold rose 0.2% to $1,952.26 an ounce

This story was produced with the assistance of Bloomberg Automation.