Asia stocks were poised to open higher Tuesday, following small gains on Wall Street in a thin trading session as markets wait for the latest US inflation figures and remarks from Federal Reserve speakers.

Futures pointed to positive openings for share markets in Tokyo, Hong Kong and Australia. The S&P 500 closed near its key 4,400 mark Monday after posting nine positive days out of 10 — a level of consistency last observed in 2021. Treasury 10-year yields dropped below 4.65%. The dollar fell. Oil topped $78 a barrel after notching three straight weeks of losses.

A batch of economic reports this week will help shape the direction of markets after a rally driven by bets interest rates are peaking. With the Fed considered by many to remain on “pause” or “skip” mode for longer, but unlikely to cut rates anytime soon, markets will possibly remain “vulnerable to outbreaks of volatility,” according to John Stoltzfus at Oppenheimer Asset Management.

“This week has enough high-profile economic data to tilt the market either way,” said Chris Larkin at E*Trade from Morgan Stanley. “Most eyes will be focused on the latest inflation numbers, but retail sales and retail earnings will also help set the tone.”

In Asia, concern lingers over the strength of China’s economic recovery, which threatens to remain a drag on global growth prospects. Data released Monday showed the nation’s consumption rebound slowed and private business confidence lost momentum in October, even after Beijing announced more fiscal stimulus.

In the run-up to the US consumer-price index report, a survey conducted by 22V Research shows the majority of investors don’t think the inflation measure is on a “Fed-friendly path.” Among those polled, 36% are betting the market reaction will be “risk-off” while 31% see a “risk-on” reaction.

Economists surveyed by Bloomberg expect the data to show CPI slowed to an annual rate of 3.3% in October from 3.7% in September.

Read: HSBC’s Kettner Embraces the Gloom-Is-Lifting Case: Surveillance

“The big event of this week will be tomorrow’s US CPI release,” said Jim Reid at Deutsche Bank AG. “The consensus suggests that the Fed have pretty much won the battle on inflation, and markets have certainly got very excited about a potential dovish pivot. But this is far from the first time that hopes for a dovish pivot have caused excitement, and if core is sticky around 3% then there’s little doubt that the Fed will look to tighten policy again.”

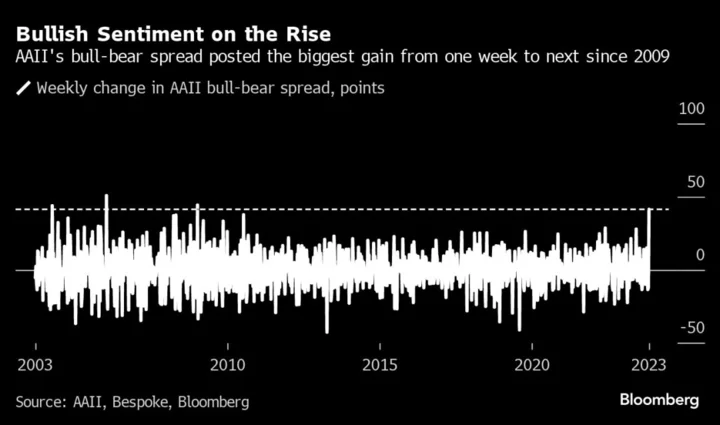

Traders betting interest rates are peaking drove the S&P 500 to an almost two-month high last week. In a survey from the American Association of Individual Investors, the proportion of respondents who say they’re optimistic on the stock market jumped by three-quarters, while the ranks of pessimists has plunged. From one weak to the next, the bull-bear spread rose by 41 points, an advance last seen in early 2009.

To Matt Maley at Miller Tabak + Co., it would actually be “healthy” if stocks took a breather. Given that many of the big-tech names have gotten “expensive” once again, a rally in a straight line could take away from some of the potential gains in December, he noted.

“We were and remain of the opinion that a bear rally would reverse at 4,435,” said JC O’Hara, chief market technician at Roth MKM. “Conversely, a sustained close above that level will indicate that the bulls oversee the market. Overall, plenty of the market’s internals have improved to neutral out of negative, but there are not many positives we can point to. Not enough good, but also not enough bad.”

Read: ETF to Cover $8 Billion in Short Options and the Market Knows It

Strategists at Morgan Stanley expect the yield on 10-year Treasuries to fall below 4% by the end of next year due to a mixture of slowing growth and inflation, alongside the return of bond buyers and rate cuts from the Fed.

Treasury bulls are still prevailing in the latest MLIV Pulse survey, but their majority is getting extremely slim. Those expecting 10-year yields to go down over the next month represented 51% of respondents, a decline from 52% a month earlier, and the peak of 54% in July.

Retail Giants

Walmart Inc. and Target Corp. will provide insights into how much consumers have reined in discretionary spending when they report earnings this week, including a glimpse into shopping patterns ahead of the vital holiday season. Home Depot Inc. is reporting Tuesday.

Wall Street is also keeping a close eye on Washington negotiations to avert a US government shutdown at the end of this week, an event that would threaten the loss of the nation’s last top credit rating after Moody’s Investors Service signaled Friday it was inclined to issue a downgrade amid wider budget deficits and political polarization.

The US fiscal position is on an “unsustainable trajectory” due to a lack of political will to resolve the crisis at a time when debt costs are soaring, former Fed Bank of New York President Bill Dudley said.

Corporate Highlights:

- Nvidia Corp., the world’s most valuable chipmaker, is updating its H100 artificial intelligence processor, adding more capabilities to a product that has fueled its dominance in the AI computing market.

- Boeing Co. opened the Dubai Airshow with a flurry of orders led by a whopping $52 billion widebody commitment from Emirates Airline, while teasing the possibility of more as China moves closer to a deal for the 737 Max.

- Tyson Foods Inc. wrote down the value of its investments in beef as US meat producers struggle with a challenging economic backdrop, tighter cattle supplies and higher costs.

- HP Inc. was upgraded to buy from neutral at Citigroup Inc., which said a better environment for personal computer demand is set to boost free cash flow generation.

- Novo Nordisk A/S’s key study backed the use of Wegovy, its blockbuster weight-loss drug, to cut heart attacks and deaths in people with obesity and a history of cardiac disease.

- Exxon Mobil Corp. plans to become one of the biggest suppliers of lithium for electric vehicles, marking the oil giant’s first major foray outside of fossil fuels in decades.

- Google pays Apple Inc. 36% of the revenue it earns from search advertising made through the Safari browser, the main economics expert for the Alphabet Inc. unit said Monday.

Key events this week:

- Germany ZEW survey expectations, Tuesday

- UK jobless claims, Tuesday

- US CPI, Tuesday

- Home Depot earnings, Tuesday

- Fed Vice Chair Philip Jefferson, SNB President Thomas Jordan and ECB chief economist Philip Lane speak during conference in Zurich. Tuesday-Wednesday.

- Chicago Fed President Austan Goolsbee speaks, Tuesday

- Bank of England chief economist Huw Pill speak during event, Tuesday.

- China retail sales, industrial production, fixed-asset investment, Wednesday

- Japan GDP, industrial production, Wednesday

- UK CPI, Wednesday

- US retail sales, business inventories, PPI, Empire manufacturing, Wednesday

- Target earnings, Wednesday

- China new home prices, Thursday

- US initial jobless claims, industrial production, Thursday

- Walmart earnings, Thursday

- US President Joe Biden and Chinese President Xi Jinping expected to speak at APEC leaders summit, Thursday

- Cleveland Fed President Loretta Mester, New York Fed President John Williams and Fed vice chair for supervision Michael Barr speak, Thursday

- Bank of England deputy governor Dave Ramsden and ECB President Christine Lagarde speak at event, Thursday

- US housing starts, Friday

- US Congress faces a midnight deadline to pass a federal spending measure, Friday

- ECB President Christine Lagarde speaks, Friday

- Chicago Fed President Austan Goolsbee, Boston Fed President Susan Collins and San Francisco Fed President Mary Daly speak, Friday

Some of the main moves in markets as of 7:24 a.m. Tokyo time:

Stocks

- The S&P 500 closed little changed

- The Nasdaq 100 closed down 0.3%

- Hang Seng futures rose 0.5%

- Nikkei 225 futures rose 0.6%

- S&P/ASX 200 futures rose 1%

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro was little changed at $1.0700

- The British pound rose 0.4% to $1.2277

- The offshore yuan was little changed at 7.2925 per dollar

- The Japanese yen was little changed at 151.73 per dollar

Cryptocurrencies

- Bitcoin was little changed at $36,490.87

- Ether was little changed at $2,058.68

Bonds

- The yield on 10-year Treasuries declined one basis point to 4.64% on Monday

- Australia’s 10-year yield rose two basis points to 4.69% on Tuesday

Commodities

- West Texas Intermediate crude rose 1.8% to $78.54 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.