Shares in Asia are poised to drop as investor concern that monetary policy makers may not be done raising interest rates fueled a further selloff in US stocks and bonds.

Equity futures for benchmarks in Japan, Australia and Hong Kong all declined. Contracts on US indexes fell in early Asia trading after stocks in New York extended this week’s losses on Thursday, with the Nasdaq 100 notching its worst three-day slide since February. The 10-year Treasury yield rose as high as 4.33%, within a few basis points of its 2022 highs.

This week’s shift down follows the publication Wednesday of minutes from the last Federal Reserve meeting that suggested officials are considering tighter policy, slamming hopes that the central bank was done raising rates. Global government bond yields reached 15-year highs on the back of resilient economic data.

Read More: Global Yields Reach 15-Year Highs as Rate-Hike Worries Build

The slump in stocks comes as investors must decide whether to roll over about $2.2 trillion of longer-dated options contracts tied to stocks and indexes that are scheduled to mature on Friday. That has led Goldman Sachs Group Inc. to warn that the activity is fueling the recent market selloff.

Tom Garretson, a senior portfolio strategist with RBC Wealth Management, said so far the stock slump has been more muted than similar eras of elevated real rates.

“Tech stocks — and certainly equities broadly — are feeling the weight of rising real yields, but thus far not to the extent that we have seen during past episodes of rising yields,” Garretson said in an interview. “During past periods over the last three years of similar rises in real yields, we have seen tech pull back by about 7% to 15%.”

Data from before the US market opened showed the labor market remains healthy, doing little to change the narrative that more tightening from Fed officials may be in store.

“This week’s data hasn’t given them any reason to let their guard down,” said Mike Loewengart at Morgan Stanley Global Investment Office. “With housing starts, retail sales, and jobless claims all reinforcing the picture of a robust economy, another rate hike can’t be ruled out, even if the Fed remains on hold next month.”

Wall Street’s fear gauge, the Cboe Volatility Index or VIX, touched 18 for the first time in seven sessions. The VIX hasn’t reached above 30 — a level considered a sign of heightened volatility — since a series of bank failures rocked the market in March.

Investors will soon be turning to next week’s gathering of policymakers at Jackson Hole in Wyoming to gauge Fed sentiment.

China also continued to weigh on sentiment. The picture emerging from property agents and private data providers suggest the slump in the real estate market may be worse than official reports show.

China ramped up its efforts to stem losses in its currency by offering the most forceful guidance since October through its daily reference rate for the managed currency. Authorities told state-owned banks to step up intervention in the currency market this week, in a push to prevent a surge in yuan volatility, according to people familiar with the matter.

Meanwhile, the dollar took a breather from a five-day climb while the pound continued to outperform. Crude rebounded from a three-week low as tightening supplies sidelined the concerns about the Chinese economy and US monetary policy.

Key events this week

- Eurozone CPI, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.1% as of 7:12 a.m. Tokyo time. The S&P 500 fell 0.8%

- Nasdaq 100 futures fell 0.2%. The Nasdaq 100 fell 1.1%

- Hang Seng futures fell 0.6%

- S&P/ASX 200 futures fell 0.4%

- Nikkei 225 futures fell 1.1%

Currencies

- The euro was little changed at $1.0871

- The yen was little changed at 145.83 per dollar

- The offshore yuan was little changed at 7.3040 per dollar

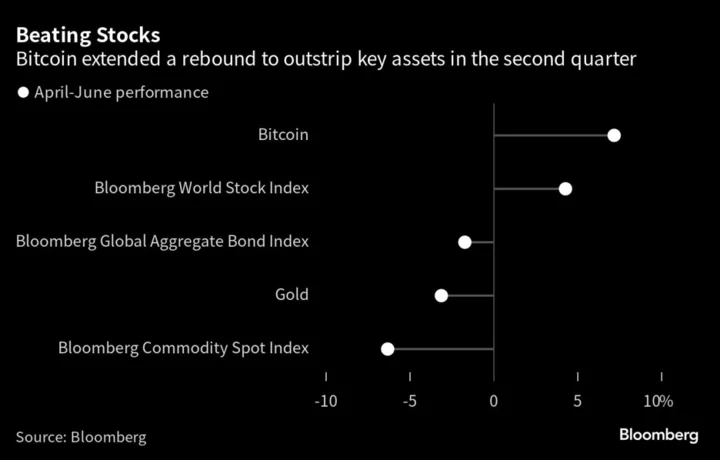

Cryptocurrencies

- Bitcoin fell 5.2% to $26,205.59

- Ether fell 5.8% to $1,616.99

Bonds

- The yield on 10-year Treasuries advanced two basis points to 4.27%

- Australia’s 10-year yield advanced 11 basis points to 4.32%

Commodities

- West Texas Intermediate crude fell 0.3% to $80.12 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Isabelle Lee and Vildana Hajric.