Asia stocks advanced after a renewed rally in tech giants pushed Wall Street higher ahead of jobs data due Friday as investors reassess the likelihood the Federal Reserve will pause interest rate hikes in June.

Shares in Japan and Australia opened higher and stock futures in Hong Kong gained further ground. US futures also ticked up following advances on the S&P 500 and the Nasdaq 100 Thursday, helped along by fresh interest for AI stocks that pushed Nvidia Corp. shares 5% higher.

Traders geared up for the monthly US jobs report on Friday, with forecasters projecting a moderation in the pace of hiring that could potentially allow the Fed to pause its tightening policy in June - a possibility hinted at by several Fed officials this week.

“We are really ripe for some type of pullback” Erin Gibbs, senior partner and chief investment officer for Main Street Asset Management said in an interview with Bloomberg Television. “There is a little cautiousness, a little uncertainty as we get a clearer idea of how the Fed will act.”

Australian bond yields spiked before quickly settling as traders assessed the fallout of the decision from the country’s Fair Work Commission to increase the minimum wage 5.75% after a review. New Zealand bond yields fell, following a Thursday decline in Treasury yields. The dollar was steady after weakening the most in more than two months in the prior session.

The won strengthened after South Korean GDP numbers outpaced estimates slightly while inflation came in softer than expected.

The country’s equities opened higher, placing the Kospi index on the edge of a bull market following a gain of nearly 20% from a recent low in September, joining other Asian markets edging toward milestones. Hong Kong’s Hang Seng index is nearing a bear market, while Philippines equities are on the cusp of a 10% correction and India’s Sensex benchmark is edging toward a gain of 10% from a recent low.

Investors also assessed the possibility of the debt-ceiling deal passing through the US Senate as senators reached a deal to expedite passage late Thursday.

Federal Reserve officials are signaling they plan to keep interest rates steady in June while retaining the option to hike further in coming months, steering market expectations ahead of a key employment report.

Fed Bank of Philadelphia President Patrick Harker said “we should at least skip this meeting in terms of an increase. In an essay Thursday, his St. Louis counterpart James Bullard, said he believes interest rates are at the low end of what’s likely to be sufficiently restrictive to bring down inflation.

Meantime, the Treasury is considering postponing its regular three- and six-month bill auctions “tentatively” scheduled for next Monday if constraints around the statutory debt limit remain.

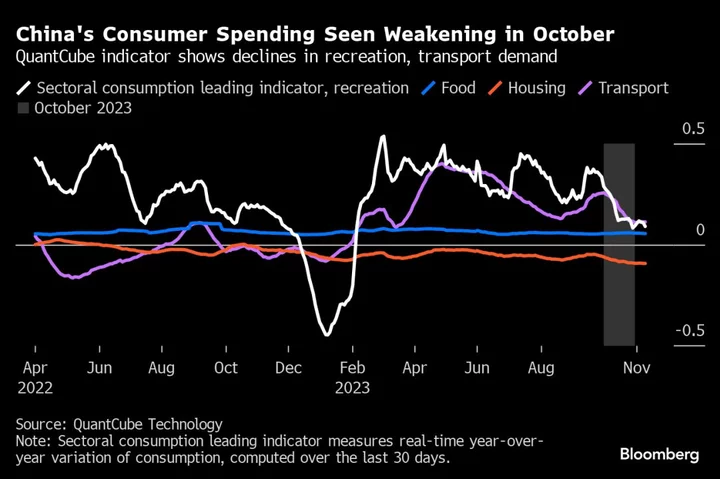

In other markets, the Bloomberg Commodity Index on Thursday followed the rally on Wall Street but is still set for a seventh weekly drop, its longest such streak since 2015, on China’s sluggish economy. Oil traders will be looking to an OPEC+ meeting over the weekend to discuss the group’s production policy.

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 9:38 a.m. Tokyo time. The S&P 500 rose 1%

- Nasdaq 100 futures were little changed. The Nasdaq 100 rose 1.3%

- Hang Seng futures rose 1.8%

- Nikkei 225 futures (OSE) rose 0.7%

- Japan’s Topix rose 0.9%

- Australia’s S&P/ASX 200 rose 0.6%

- Euro Stoxx 50 futures rose 0.2%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0760

- The Japanese yen was little changed at 138.89 per dollar

- The offshore yuan was little changed at 7.1088 per dollar

- The Australian dollar was little changed at $0.6575

- The British pound was little changed at $1.2525

Cryptocurrencies

- Bitcoin fell 1.3% to $26,521.34

- Ether fell 1.1% to $1,848.62

Bonds

- The yield on 10-year Treasuries advanced one basis point to 3.60%

- Japan’s 10-year yield declined 1.5 basis points to 0.400%

- Australia’s 10-year yield declined three basis points to 3.59%

Commodities

- West Texas Intermediate crude was little changed

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.