Asian stocks advanced, following US equities with modest gains Monday after Jerome Powell said the Federal Reserve would “proceed carefully” on whether to raise interest rates again, while signaling policy will remain tighter for longer.

Shares opened higher in Japan, South Korea and Australia. The moves followed the S&P 500’s 0.7% advance Friday, when it capped its best week since July. Contracts for US benchmarks steadied on Monday and those for Hong Kong stocks were little changed.

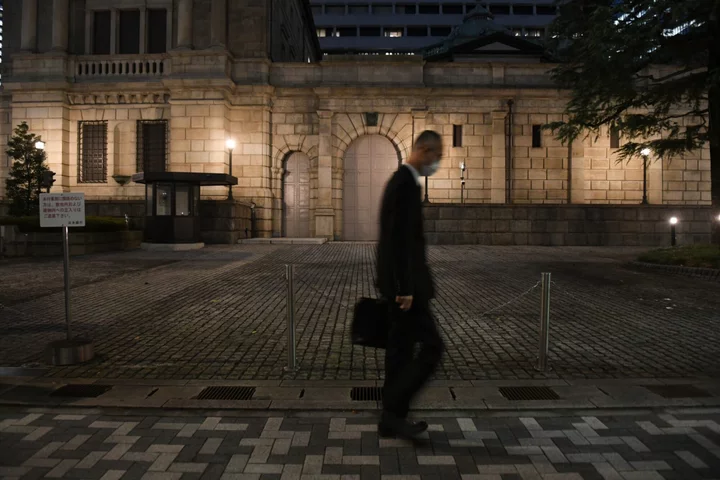

Most major currencies were held to narrow ranges in early Asian trading, though the yen weakened slightly after sliding to its lowest this year on Friday after the Fed chief’s remarks. Bank of Japan Governor Kazuo Ueda didn’t comment on foreign-exchange rates but said price growth remains slower than the central bank’s goal.

The euro was unchanged and largely resistant to European Central Bank President Christine Lagarde’s vow to set borrowing costs as high as needed and leave them there until inflation is in check. The yuan will remain in focus amid China’s campaign to prop-up the currency.

Investors in Chinese equities have countervailing forces to weigh, with data on Sunday showing a decline in industrial profits eased while deflation risks remain an overhang. China also announced measures to support the equities market, lowering the stamp duty on stock trades for the first time since 2008 and pledging to slow the pace of initial public offerings.

Treasury yields were slightly higher in Asia, with the yield on two-year paper, which is highly sensitive to the Fed’s policy shifts, now above 5%. Treasuries were little changed during Powell’s long-awaited speech in Jackson Hole, but yields pushed up after it concluded as the longer-for-higher rates message appeared to sink in on Friday. Australia’s three-year bond yield inched up Monday while 10-year rates declined.

As Treasury yields stay high and the Fed is likely to hike one more time this year, “high quality fixed income still presents a strong risk-adjusted investment opportunity,” said Aninda Mitra, a macro and investment strategist at BNY Mellon Investment Management in Singapore. “Long-term investors will be able to capture very attractive yields over the holding period of 12 months or more.”

Still, Powell cautioned that the process of bringing inflation back to its target “still has a long way to go.” He also suggested officials could hold rates steady in September, as investors expect.

“At the end of the day, this speech will be soon forgotten and it’s all going to depend on how the data evolves, as indeed it should,” said Sharon Zollner, chief economist at Australia & New Zealand Banking Group’s New Zealand unit. “Central banks making ‘promises’ in order to influence the yield curve only to have the data nullify them has not, in hindsight, done the world any favors in recent years.”

Fed Bank of Philadelphia President Patrick Harker signaled he favored holding rates at current levels to allow the effects of cumulative tightening to work through the system. His Cleveland counterpart Loretta Mester noted that under-tightening interest rates would be “a worse mistake” than raising them too much. Fed Bank of Chicago head Austan Goolsbee said the Fed is part of the way down the road to a soft landing.

Meanwhile, this week in Asia will be a busy one for investors with more than 360 members of the MSCI Asia Pacific Index expected to announce results in the highest weekly tally this season. Traders will watch for signs of corporate profits bottoming out, which may support further gains in Asian equities.

Elsewhere, oil advanced and gold steadied.

Key events this week:

- US Conference Board consumer confidence, Tuesday

- Eurozone economic confidence, consumer confidence, Wednesday

- US GDP, wholesale inventories, pending home sales, Wednesday

- China manufacturing PMI, non-manufacturing PMI, Thursday

- Japan industrial production, retail sales, Thursday

- Eurozone CPI, unemployment, Thursday

- ECB publishes account of July monetary policy meeting, Thursday

- US personal spending and income, initial jobless claims, Thursday

- China Caixin manufacturing PMI, Friday

- Eurozone S&P Global Eurozone Manufacturing PMI, Friday

- South African central bank governor Lesetja Kganyago, Atlanta Fed President Raphael Bostic, BOE’s Huw Pill, IMF’s Gita Gopinath on panel at the South African Reserve Bank conference, Friday

- Boston Fed President Susan Collins speaks at virtual event, Friday

- US unemployment, nonfarm payrolls, light vehicle sales, ISM manufacturing, construction spending, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 9:20 a.m. Tokyo time. The S&P 500 rose 0.7%

- Nasdaq 100 futures were little changed. The Nasdaq 100 rose 0.85%

- Japan’s Topix rose 0.9%

- Australia’s S&P/ASX 200 rose 0.5%

- Euro Stoxx 50 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0801

- The Japanese yen was little changed at 146.50 per dollar

- The offshore yuan rose 0.2% to 7.2835 per dollar

- The Australian dollar rose 0.2% to $0.6419

Cryptocurrencies

- Bitcoin was little changed at $26,070.85

- Ether rose 0.1% to $1,656.16

Bonds

- The yield on 10-year Treasuries advanced one basis point to 4.25%

- Australia’s 10-year yield declined two basis points to 4.14%

Commodities

- West Texas Intermediate crude rose 0.3% to $80.10 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth and Matthew Burgess.