Shares in Asia declined while Treasury yields and the dollar rose in a sign investors are yet to fully recalibrate interest rate expectations.

Equity benchmarks in Japan and Australia opened lower, while share futures for Hong Kong inched higher, following heavy selling Monday. US equity futures were also moderately lower after a small advance for Wall Street on Monday.

Treasury yields climbed in early Asian trading, extending a Monday advance. The 10-year Treasury yield added 11 basis points to set a fresh 16-year high on Monday to trade above 4.54%, a level last seen in 2007. The momentum flowed into Asia, with Australian and New Zealand yields also climbing.

“Rates will stay high,” BlackRock Investment Institute analysts including Wei Li, global chief investment strategist, wrote in a note. Quantitative tightening and Treasury issuance in the US could spur yields higher in the near term. “Rising long-term bond yields show markets are adjusting to risks in the new regime of greater macro and market volatility.”

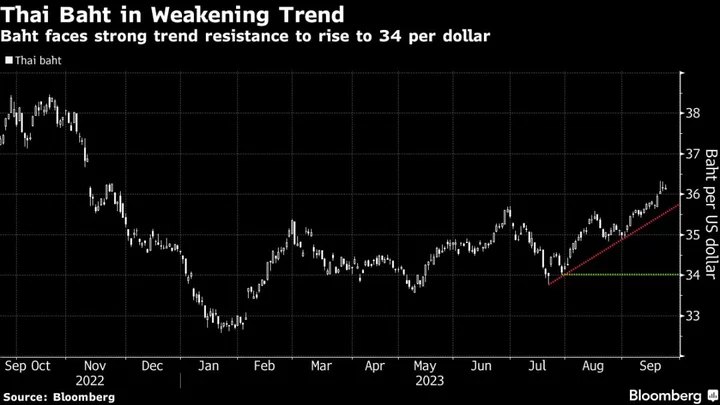

Rising yields supported the greenback. The Bloomberg dollar index held its gains from Monday, when it closed at the highest level since December. The yen weakened to a fresh-year low after Bank of Japan officials doubled down on the message that stimulus is still needed.

Attention in Asia will be focused on fresh signs of turmoil for China’s property developers, after their stocks tumbled the most in nine months on Monday when China Evergrande Group missed a debt payment and former executives were detained. That added to fears about the sector’s debt pile and compounded concern that global growth will stall as the economic engine of the world’s second biggest economy sputters.

A warning that a US government shutdown would reflect poorly on America’s credit rating from Moody’s Investors Service did little to shift market sentiment Monday. Concerns about a shutdown may intensify later this week as Oct. 1 draws near.

Crude prices were flat after a small decline Monday. Traders are increasingly concerned that rising oil prices risk fanning inflation, which will make it difficult for policymakers to reduce rates anytime soon. Hedge funds boosted exposure to oil on bets tightening supplies will stoke demand.

Fed Bank of Chicago head Austan Goolsbee said it’s still possible for the US to avoid a recession. “I’ve been calling that the golden path and I think it’s possible, but there are a lot of risks and the path is long and winding,” he said in a CNBC interview.

Two Fed officials last week said at least one more rate hike is possible and that borrowing costs may need to stay higher for longer for the central bank to ease inflation back to its 2% target. While Boston Fed President Susan Collins said further tightening “is certainly not off the table,” Governor Michelle Bowman signaled that more than one increase will probably be required.

“There are several reasons to believe that the full impact from tighter monetary policy is still yet to take effect,” said Henry Allen, a strategist with Deutsche Bank. “As such, it will be some months before we can sound the all clear for the economy, not least given longer-term interest rates are still reaching new highs even now.”

Key events this week:

- US new home sales, Conference Board consumer confidence, Tuesday

- ECB’s Philip Lane speaks on monetary policy, Tuesday

- China industrial profits, Wednesday

- US durable goods, Wednesday

- Eurozone economic confidence, consumer confidence, Thursday

- US initial jobless claims, GDP, Thursday

- Fed Chair Jerome Powell town hall meeting with educators while Richmond Fed President Tom Barkin, Chicago Fed President Austan Goolsbee make speeches, Thursday

- Eurozone CPI, Friday

- Japan unemployment, industrial production, retail sales, Tokyo CPI, Friday

- US consumer spending, wholesale inventories, University of Michigan consumer sentiment, Friday

- ECB President Christine Lagarde speaks, Friday

- New York Fed President John Williams speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.2% as of 9:41 a.m. Tokyo time. The S&P 500 rose 0.4%

- Nasdaq 100 futures fell 0.2%. The Nasdaq 100 rose 0.5%

- Hang Seng futures rose 0.2%

- Japan’s Topix fell 0.6%

- Australia’s S&P/ASX 200 fell 0.5%

- Euro Stoxx 50 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0583

- The Japanese yen was little changed at 148.74 per dollar

- The offshore yuan was little changed at 7.3149 per dollar

- The Australian dollar was little changed at $0.6419

Cryptocurrencies

- Bitcoin was little changed at $26,264.07

- Ether was little changed at $1,586.82

Bonds

- The yield on 10-year Treasuries advanced one basis point to 4.55%

- Japan’s 10-year yield advanced 1.5 basis points to 0.745%

- Australia’s 10-year yield advanced 11 basis points to 4.42%

Commodities

- West Texas Intermediate crude was little changed

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Jason Scott.