Sign up for the India Edition newsletter by Menaka Doshi – an insider's guide to the emerging economic powerhouse, and the billionaires and businesses behind its rise, delivered weekly.

Asian loan volumes are poised for a rebound in 2024 thanks to expected deal flows in Australia and India that should help offset the dent from China’s economic slowdown.

That’s the view of a number of bankers who recently gathered at the Asia Pacific Loan Market Association conference in Singapore. AirTrunk’s A$4.6 billion ($3 billion) loan last month, Australia’s largest syndicated deal this year, and Adani Group’s talks for borrowings to refinance $3.5 billion of debt are among signs of the likely pickup in activity in those two countries.

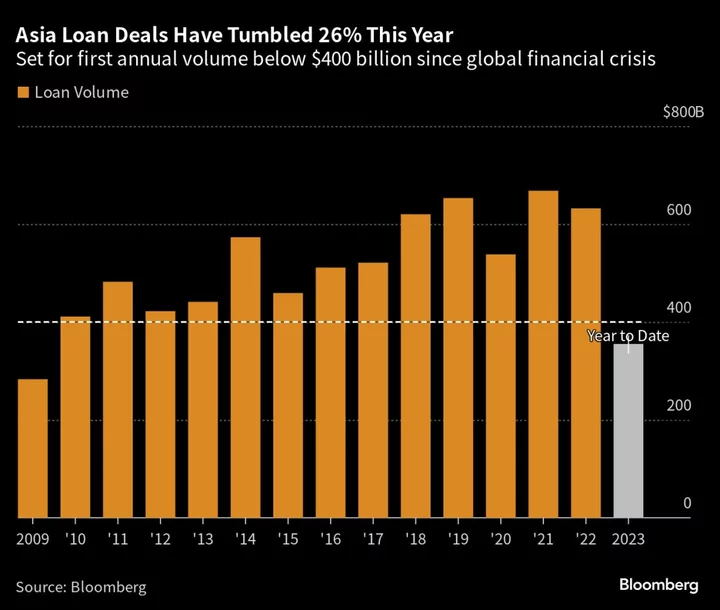

The reality that hovered over that conference was that loan volumes in the region outside Japan and excluding bilaterals have slumped 26% on year to $355 billion so far in 2023, headed for the first annual total below $400 billion since the global financial crisis, according to Bloomberg-compiled data.

But a revival in sponsor-backed merger and acquisition activity, along with an expected end to the rate-hike cycle by most major central banks could help change the dynamic next year. Loan volumes in the region will likely rise at least 10% in 2024, according to Amit Khattar, Asia Pacific head of investment banking and co-head of global financing and credit trading at Deutsche Bank AG.

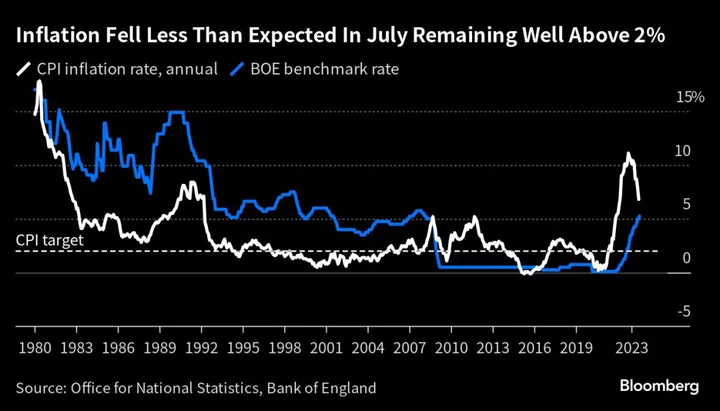

Andrew Ashman, head of loan syndicate for Asia Pacific at Barclays Bank Plc, sees such a rate of expansion at least in Australia and India. “There is now better visibility on the outlook for rates and inflation which is driving confidence from corporates and sponsors alike,” he said. “ This will naturally lead to more M&A and capex investments, all of which will need financing in the debt markets.”

Asia has been no exception to a global decline in loan deals this year, an outcome of rising interest rates and concerns about slowing economic growth and China’s property debt crisis. Still, the drop in the region’s volumes, excluding Japan’s, has been slightly milder than that in the US and Europe.

“While private equity investments in Asia slowed to nearly $200 billion last year from about $350 billion in 2021, the long-term trend of increasing key ownership of assets remains intact,” Deutsche Bank’s Khattar said. “A record $650 billion of dry powder with these businesses today will be invested and will need to be financed.”

(Updates with elsewhere in credit section at bottom.)