The drive south from the ancient city of Tangier spans decades of economic development in half an hour, winding through hills where shepherds tend their flocks, and then down into a valley that’s home to Africa’s biggest car-assembly factory.

In this burgeoning industrial zone, there’s room for businesses from both sides of the new Cold War. And like many key emerging economies, Morocco wants to keep it that way, even if walking the line won’t be easy in a polarizing world.

Western corporations are already here in droves and still moving in, riding the near-shoring wave. Just across the expressway from Renault SA’s 8,000-employee plant is the 1,500-acre Tanger Automotive City, which hosts dozens of companies like Michigan-based seating supplier Lear Corp. and French component maker Valeo.

Now China is stepping up its presence, trying to reach more markets globally. Among the newer operators in the auto cluster is the fiber-optic cable producer ZTT Group, an active player in Beijing’s grand plan to crisscross the planet with Belt and Road infrastructure. Last month, battery maker Gotion High-Tech Co. signed a memorandum of understanding with the kingdom to build a $6.4 billion factory for electric-vehicle batteries in Morocco, which would be one of the world’s largest.

“Today we have many Chinese companies that are considering Morocco – and some announcements will be made very soon,” Ahmed Bennis, managing director of Tanger Med Zones, said in an interview earlier this month.

The location for many of them: Tanger Tech City, which envisions scores of Chinese companies in a “smart city,” complete with public infrastructure, residential areas and tourist facilities.

“Chinese companies initially were looking at expanding in Vietnam, or expanding in South Asia,” Bennis said. “Now they’re considering Morocco.”

All of this looks like globalization as it was widely envisaged in the decades after the last showdown of superpowers ended. But the escalating clash between Washington and Beijing leaves smaller economies from South Africa to Saudi Arabia caught in the middle, and under pressure to pick sides.

‘Hedges Its Bets’

“Morocco is watching what other countries are doing to see how they can balance these competing interests,” and US government officials in particular “are aware that Morocco hedges its bets,” said Geoff Porter, the founder of North Africa Risk Consulting Inc. “They would argue that that’s perfectly within Morocco’s rights to do, but when push comes to shove, Morocco will have to make a choice.”

Moroccan officials are betting they can avoid that for now, as the country’s position on the doorstep of Europe and Africa and its free-flowing trade with the US makes it attractive for firms from all over the world that want to produce for those markets.

The logistics of manufacturing in Morocco depend on the Tanger Med deep-sea port and the foreign companies positioned to move the goods. Every day, 50 or 60 truckloads of goods operated by Greenwich, Connecticut-based XPO Inc. board ferries headed across the Strait of Gibraltar to Spain.

Most of XPO’s business involves shipping between Morocco and Europe, and two of its main customers are Chinese auto-part makers. Luis Gomez, XPO’s European president, says the company seeing its revenue in Morocco grow by about 30% a year.

Helping increase the flow of trade is the Tanger Med port, which rivals some of Europe’s most established trade gateways in volume and connections to markets around the world. And it’s still expanding, with more berth space for container ships and capacity for car exports. On a recent morning, some of the first Moroccan-made electric vehicles were parked on the pier awaiting shipment.

Morocco is building another massive port near the Mediterranean city of Nador, aiming to replicate the Tanger’s success.

Lately ports have been the subject of intense national-security debate, given China’s vast reach in maritime shipping. But at Tanger Med, the terminals are mostly operated by Europe’s biggest shipping companies including Germany’s Hapag-Lloyd AG. Rolf Habben Jansen, the container carrier’s chief executive, said Tanger’s location serves a wide range of needs.

“If you move cargo for example out of Asia, you can either use Tanger to distribute it in the west Mediterranean. You can also use it to move it into North Europe. You can also move it into Africa, or into the US or into South America,” he said in an interview. “We’d be happy to invest more in it.”

‘Empty Fields’

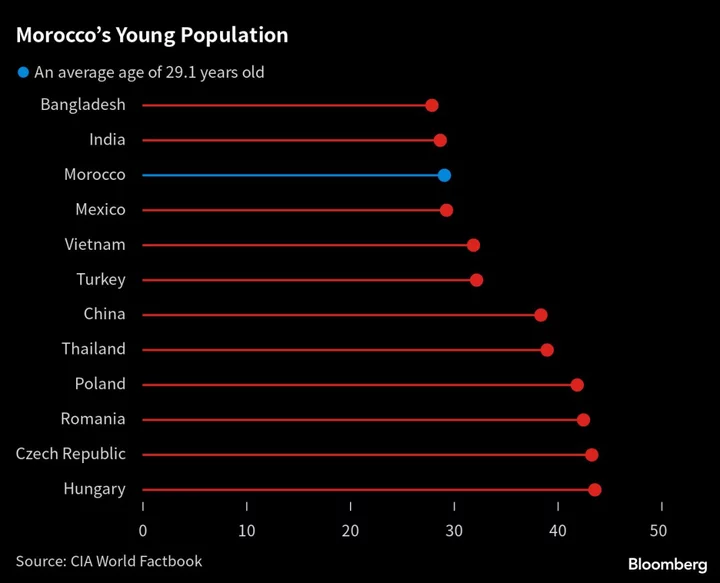

Morocco’s relationship with the west runs deeper than the trade and investment ties. With 37 million people and an economy the size of Mississippi’s, it’s on a select list of countries designated as a “major non-NATO ally” of the US. That makes it eligible for defense and security cooperation, which comes in handy in regional territorial disputes. Such bonds are what makes China’s strategy there all the more complicated.

The US dethroned France last year as the largest source of foreign direct investment in Morocco, according to government figures, while China crept into the top 10.

Huawei Technologies Co. and ZTE Corp. — two Chinese tech giants that western officials worry pose national-security risks — are already on the ground in Morocco and aggressively recruiting young engineers. By 2027, there may be some 200 more Chinese tech firms operating there if the plans pan out for the high-tech industrial zone.

Few American executives have witnessed the country’s two decades of transformation more closely than Julianne Furman, the Europe general manager for auto supplier Polydesign Systems, which makes interior trim and seating parts at a 1,600-person plant in the Tanger Free Zone — and ships them all over the world.

The firm started out there with 50 employees in 2001, “back when it was empty fields with sheep grazing,” she said. Furman sees geopolitical risks from the US-China contest as real, but navigable.

“It’s a fine line to not irritate one while you make the other happy, but Morocco seems to be able to — so far — walk that line,” she said.

She cites some upsides of manufacturing there for global customers: Absenteeism and employee turnover is way lower than factories in central Europe that she used to manage. If Polydesign wanted to operate in a higher-cost country like the UK that has more automation, labor would cost 10 to 12 times more, Furman said.

Boeing and Huawei

There remain plenty of obstacles to an investment-recruiting campaign that’s used up about half the designated land. Morocco’s labor market, for example, “doesn’t seem in great shape to pick up this challenge,” World Bank economist Federica Marzo said. Female participation is low, child-care options outside families are scarce and daily commutes are tough slogs for many workers.

During shift changes at Renault, for example, convoys of buses back up traffic carrying the employees to and from the Tanger factory. About 150 of the shuttles come and go full of passengers each day who face round-trip commutes of three hours. Morocco opened a high-speed train in 2018 linking Tangier with the capital, Rabat, and Casablanca — but it’s not much use to many rural Moroccan workers, because of the cost and limited stops.

On top of mobility and better gender balance, the young workforce needs improved skills. That’s where the US and China are competing on the ground: Two programs that got under way in April showed the great-power rivalry in microcosm.

US aerospace giant Boeing Co. teamed up with the Ministry of Youth, Culture and Communications to launch a four-month STEM training program for dozens of 18- to 25-year-olds. Meanwhile, Huawei’s Moroccan unit held masterclasses at a local engineering school, with programs to strengthen IT skills.

China is much more assertive when it comes to recruiting and training local students, said Rabia El Alama, managing director of the American Chamber of Commerce in Morocco. She lives near about 150 young Chinese executives who work at Huawei and ZTE. They speak the local dialect and assimilate well into the community.

Huawei, for example, is “going into universities, setting up academies, giving grants, giving students scholarships to go to China,” she said. “I wish the US would give scholarships to students.”

More on Morocco:

- Morocco Ends Historic Streak of Rate Hikes With a Surprise Hold

- US Lawmakers to Press Auto CEOs Over China Supply Chains

- How ‘Friend-Shoring’ Could Make US More Like China (Podcast)

- Moving Saharan Sunshine and Wind to Europe Via Undersea Cable

- Spain Plans €800 Million Credit Line to Revamp Ties With Morocco

--With assistance from Caroline Alexander, Souhail Karam and Jeremy Diamond.