As a dense but brief European earnings season draws to a close, a handful of big hitters spanning energy, commodities, pharmaceuticals and food delivery remain.

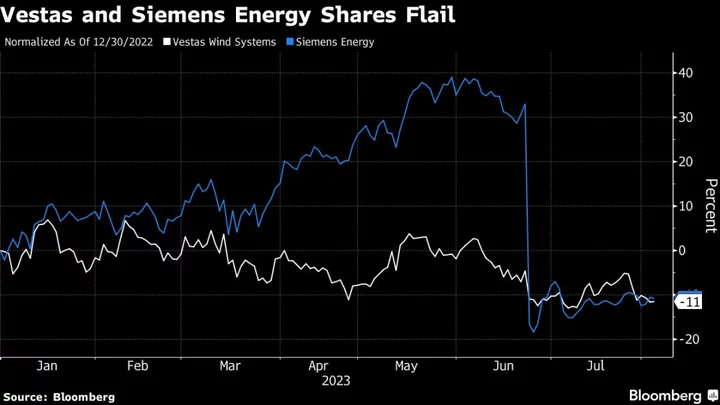

Oil behemoth Saudi Aramco kicks off a week that will also see two companies serving the opposite end of the energy spectrum report: wind turbine producers Vestas Wind Systems A/S and Siemens Energy AG. While Aramco’s vast reserves, balance sheet and low lifting costs make it profitable in most oil-price scenarios, Vestas and Siemens Energy are trying to straighten out supply chain issues and design flaws that have dented their shares.

Mining and trading powerhouse Glencore Plc, reporting on Tuesday, has been making more waves lately with its pursuit of Canada’s Teck Resources Ltd. than on the earnings front. Strong cash-flow generation and a reduction in working capital increase the scope for another share buyback, though it may keep most of its powder dry for potential acquisitions, according to Bloomberg Intelligence.

Danish drugmaker Novo Nordisk A/S has also grabbed headlines with the rollout of weight-loss drug Wegovy in Europe, which has helped propel it into the top three in the Stoxx Europe 600 Index by market value. Results from food delivery firm Just Eat Takeaway.com NV last week may be a prelude to updates from Deliveroo Plc and HelloFresh SE. Like their Dutch peer, they’re expected to post a year-on-year drop in orders and active users in what are otherwise expected to be solid reports.

Highlights to look out for next week:

Monday: Aramco (ARAMCO AB) probably saw second-quarter revenue and operating profit drop more than 30%, reflecting the decline in oil prices, consensus shows. Still, the premium its oil carries over Brent and its limited exposure to softer gas prices signal resilience over peers, analysts at JPMorgan said. They expect management to affirm a commitment to the special dividend policy introduced earlier this year. Revenue may stay muted in 2023 after Saudi Arabia’s voluntary production cut of 1 million barrels a day, unless oil prices jump substantially again, BI’s Salih Yilmaz said. Cash generation should remain robust, covering dividends and increased capital spending.

- The June profit warning that wiped out €6 billion of Siemens Energy’s (ENR GY) market value begs more questions about the financial impact of quality issues at its wind turbine unit. While the company said costs associated with failures of its onshore platforms will probably exceed €1 billion, investors will scan the third-quarter report just as closely for clarity on any effect on offshore platforms, Citi analyst Vivek Midha said. Estimates compiled by Bloomberg point to a loss before special items of €1.12 billion. The company is trying to delay delivery of new turbines from the troubled 5.X platform as it races to contain the fallout. Repair costs could well exceed its estimate if deeper design flaws are discovered, Bloomberg has reported.

Tuesday: With Glencore’s eyes fixed on M&A, it might only boost shareholder returns by $1.5 billion to $2 billion, despite having capacity for double that, BI said. Lower coal prices and shrinking marketing profit probably damped first-half earnings, with consensus pointing to adjusted Ebitda of $10.2 billion to $12.5 billion, down from $18.9 billion a year earlier. Its recent trading update signaled that volumes will be weighted toward the second half, implying elevated costs and pinched margins in the first six months, BI said. Looking ahead, the focus will be on operational recovery, changes in working capital and capital allocation strategy, Citi analysts said.

Wednesday: Vestas (VWS DC) likely continued its Ebitda recovery in the quarter, albeit with a “modest” 3% to 6% margin, according to BI. Estimates compiled by Bloomberg point to Ebitda of €155 million. A projected order intake of about 3 gigawatts in the period should propel future profit and sales gains, it said. Vestas may also address Siemens Energy’s setbacks.

- ABN Amro’s (ABN NA) net interest income probably grew at an even faster clip in the second quarter than the first, consensus shows. A reduction in headcount meant expenses likely fell 1%, with credit quality remaining steady, BI said. Its results, due at 7 a.m. local time, follow Dutch rival ING’s update on Thursday, which showed a slight net interest margin dip, a possible sign that NII growth rates may be peaking. Pressure to pass on interest rate hikes to depositors is ABN Amro’s biggest threat, BI said.

Thursday: Novo Nordisk (NOVOB DC) is expected to reiterate full-year guidance, given the Wegovy supply constraints, which probably limited its ability to start new patients on the drug in the quarter. Still, sales of the drug are estimated to have jumped almost sixfold to 6.98 billion kroner ($1 billion). Revenue and operating profit each likely climbed 33%, consensus shows. Investors are awaiting more clinical trial data, due this month, and more reassurances of Wegovy’s chances in the diabetes and obesity markets following recent strong data from rival Eli Lilly’s retatrutide drug.

- HelloFresh (HFG GR) will elaborate on last month’s preliminary results, which — although better than anticipated — raised questions about quality. Profit gains were driven in part by lower outlays for marketing, which may pick up in coming quarters, analysts said. A decline in user numbers precedes a seasonally weak third quarter and means a “substantial rebound” is needed in the second half to meet year-end goals, BI’s Diana Gomes said.

- Deliveroo’s (ROO LN) growth in its core UK and Ireland markets may not be sufficient to offset a decline elsewhere, Gomes said. While cost cuts and its departure from some markets make the full-year adjusted Ebitda target “feasible,” key things to watch are order rates and active-user metrics, she said.

Friday: No major earnings of note

- To subscribe to earnings coverage across your portfolio or other earnings analysis, run NSUB EARNINGS.

- Follow our Top Live blogs for real-time coverage and analysis of the biggest results.

- For more on what’s going on in other regions, see the US Earnings Week Ahead or the Asia Earnings Week Ahead, and see the ESG Week Ahead for a selection of the environmental, social and governance themes that may come up on the week’s earnings calls.

--With assistance from Maggie Shiltagh, Laura Malsch, Anton Wilen, Andrey Biryukov and April Roach.

Author: Chloé Meley