Alibaba Group Holding Ltd.’s options are flashing positive signs ahead of the Chinese tech company’s June quarter results.

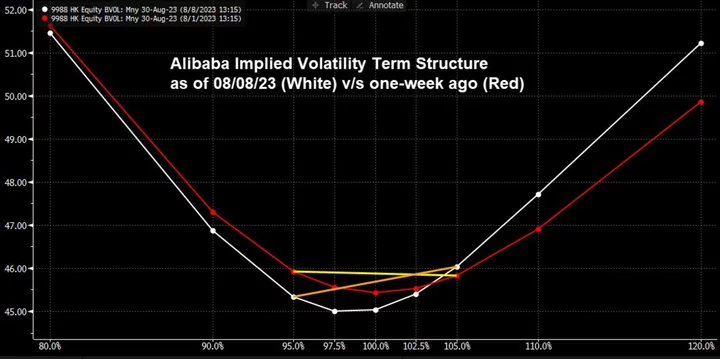

As of Tuesday’s close, a bullish option contract betting on a 5% rally for Alibaba’s Hong Kong-listed shares was quoted at a bigger premium than a bearish contract, according to data compiled by Bloomberg. The volatility skew, a gauge of market positioning and sentiment, has shifted toward the more optimistic side compared to a week ago.

The market expects the e-commerce company to report its fastest revenue growth in more than a year on Thursday, aided by restructuring efforts and a consumption recovery. The implied volatility in the options market is indicating a 5.4% move the day after the results, set to be its biggest post-earnings reaction since February 2022.

“The second-quarter earnings should show a good recovery and the stock is not expensive at all,” said Kenny Wen, head of investment strategy at KGI Asia Ltd. “Having said that, any solid earnings could be overshadowed by the current economic worries because the businesses of Alibaba are highly cyclical.”

A proxy of the Chinese economy, Alibaba has been hit by a sluggish consumption rebound and fierce competition from smaller rivals this year. The stock trades at about 11 times its forward 12-month earnings, a utility-like valuation as investors remain doubtful over its recovery following years of regulatory crackdowns. Its Hong Kong listing fell as much as 1.4% on Thursday. It’s up about 8% this year.

Read: Alibaba, Tencent’s $66 Billion Party Starts to Fade: Tech Watch

Investors are waiting for Alibaba to unveil more details about its spinoff listing progress after announcing an overhaul in March, as well as guidance for the coming quarters as Joseph Tsai becomes chairman in September.

--With assistance from Akshay Chinchalkar.

(Updates with Thursday’s share performance in the penultimate paragraph. An earlier version corrected Tsai’s title in the last paragraph.)