Bets that artificial intelligence will revolutionize Corporate America and deliver riches to the biggest companies behind it will get a test Tuesday, as Microsoft Corp. and Alphabet Inc. report their first earnings since AI fever broke out.

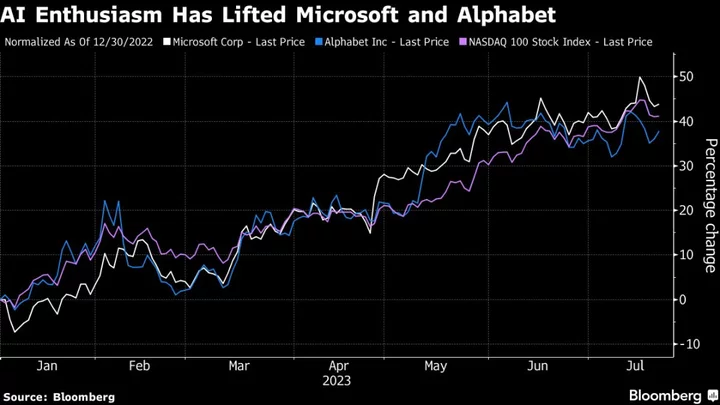

Microsoft’s shares have soared 45% in 2023, hitting multiple records in a rally that has left it on the cusp of joining Apple Inc. as the only two companies with market valuations of $3 trillion. Alphabet’s rally stands at 39%, slightly under the Nasdaq 100 Index’s 41% gain. Both are among the early leaders in publicly traded tech behemoths with promising AI tools.

Microsoft gained 0.5% on Tuesday while Alphabet was up 0.4%. The Nasdaq 100 Index rose 0.3%.

The results, due after the market closes, will demonstrate whether the technology is already a big enough driver of growth to justify valuations that have become elevated by recent standards. Microsoft is trading at 31 times estimated earnings, above its long-term history and at a premium to the Nasdaq 100 Index.

“It might be too early to see any AI impact to revenue, though we will likely see higher costs as it develops and distributes the technology, which could be an issue from a profitability standpoint,” BNP Paribas Exane analyst Stefan Slowinski said of Microsoft ahead of its results. “The fundamentals are obviously quite strong for Microsoft, and it will benefit from AI, but at this valuation you have to scrutinize the risks more.”

Alphabet is likely to be in a similar boat, with investors looking to see whether its Bard chatbot will disrupt the company’s main moneymaker — search advertising — with people asking the AI tool for tips on where to go on vacation and how to do common tasks, rather than using its Google search engine.

That’s not to say the two firms have become beholden to AI. Microsoft still generates billions from its software products and cloud business, while Google’s ad engine remains unrivaled. Still, with markets — rightly or wrongly — keying in on AI, it will be the performance, prospects and costs of that division that are most heavily scrutinized at each company.

Alphabet and Snap Inc., which also delivers results Tuesday evening, will also give an indication on whether the digital advertising market is recovering from a slump. Meta Platforms Inc., another key AI tech firm, will report its results after the close of trading Wednesday.

The Mark Zuckerberg-led company has been dealing with a complication of its own with its ad business, beyond tightening budgets: It’s trying to sell more short-form video advertising for its TikTok-like product called Reels. Users have been spending more time swiping through them, but advertisers haven’t caught on as quickly.

Lackluster results last week from two other Nasdaq 100 giants, Netflix Inc. and Tesla Inc., showcased just how quickly fortunes can turn, even for market darlings. Tesla tumbled nearly 10% after the carmaker warned that its already shrinking profitability was likely to fall even further. Netflix declined by the most in seven months after forecasting revenue for the third-quarter that fell short of analyst expectations.

Daniel O’Regan, a managing director of equity trading at Mizuho Securities, wrote that “this is one of the most important earnings seasons in recent memory. The tape has rallied so hard and so fast, it’s almost like a game of musical chairs. People are wondering if/when will the music stop especially in single stocks.”

The stakes are also high for the broader market. The seven-largest companies in the S&P 500 — which are primarily tech and internet firms — outperformed the rest of the index by the most since the dot-com bubble during the first half of the year, according to data compiled by Bloomberg Intelligence. Without them, the benchmark index’s 16% gain would have been cut by more than half.

“Even though stocks have moved significantly to date, we’re still in such an early innings of AI adoption, which means we still see a lot of upside for companies like Microsoft, which is clearly a significant beneficiary,” said Erika Klauer, technology equity portfolio manager at Jennison Associates.

In total, roughly 170 companies in the S&P 500 Index are set to post results this week, representing 40% of its total market capitalization. For investors, next week may prove to be just as pivotal, with both Apple Inc. and Amazon.com Inc. scheduled to release their results after the close of trading Aug. 3.

Tech Chart of the Day

The Nasdaq 100 Index closed with a free cash flow yield of 2.41% on Monday, near its lowest level in more than 20 years, and down from a 2022 peak of nearly 4.2%. The drop in this metric comes amid a gain of more than 40% in the tech-heavy benchmark this year.

Top Tech Stories

- Apple Inc. is asking suppliers to produce about 85 million units of the iPhone 15 this year, roughly in line with the year before, according to people familiar with the matter.

- Elon Musk has decreed that Twitter’s product name would be changed to “X,” and that he is getting rid of the bird logo and all the associated words, including “tweet.” Musk’s move wiped out anywhere between $4 billion and $20 billion in value, according to analysts and brand agencies.

- Musk on Monday explained his decision to strip Twitter of its famous blue-bird logo as a move to remake the business into a broad platform for communications and financial transactions, a target he’s described as the everything app.

- Adobe Inc.’s $20 billion takeover of design startup Figma Inc. is on course for an in-depth investigation from European Union merger regulators, adding to growing global scrutiny of the deal dubbed by Adobe’s boss as “transformational.”

- Executives and politicians across the world worry about the havoc that next-generation artificial intelligence will wreak on industries from finance to health-care. For the $200 billion games sector, the revolution has already begun.

Earnings Due Tuesday

- Premarket

- CTS Corp. (CTS US)

- Corning Inc. (GLW US)

- Verizon Communications Inc (VZ US)

- Xerox Holdings Corp (XRX US)

- Postmarket

- Alphabet Inc. (GOOGL US)

- Manhattan Associates Inc. (MANH US)

- Microsoft Corp. (MSFT US)

- Pros Holdings Inc. (PRO US)

- Snap Inc. (SNAP US)

- Tenable Holdings Inc. (TENB US)

- Texas Instruments Inc. (TXN US)

--With assistance from Sarah Frier, Subrat Patnaik, John Viljoen and David Watkins.

(Updates to market open.)