The Philippines is racing to defend its share of the nearly $300 billion global business process outsourcing market as it battles deteriorating talent, rising competition and rapidly evolving artificial intelligence.

The Southeast Asian nation, the world’s second-largest provider of outsourcing services, is producing a “low ratio” of graduates with the required level of communication and technical skills, potentially losing out on opportunities to add 800,000 jobs in the next five years, according to industry group IT & Business Process Association of the Philippines.

“The most common challenge I hear is comprehension,” Jack Madrid, who heads the country’s main BPO trade group, said in an interview, referring to failed job seekers. “I think they fail at a more basic level,” he said in his office in Manila on Aug. 2.

The skills gap is making it tougher for the Philippines to defend its turf in an industry that has helped expand its middle class since the 1990s — outsourcing accounts for around 8% of the nation’s gross domestic product and is a major source of foreign exchange inflows. As AI-powered bots take away an increasing number of outsourcing jobs since the Covid-19 pandemic, the rise of English-speaking workers around the world is also diminishing the longstanding language advantage for natives of the former US colony.

Illustrative of the deterioration in the quality of education in the country, nine out of 10 Filipino children are unable to read a simple text with comprehension by age 10, according to World Bank data.

“I think we were better English speakers before,” Madrid said, urging the government to consider reverting to English as a mode of instruction in schools instead of the learner’s mother tongue.

Job applicants in the Philippines are also falling short on basic information technology skills like programming and troubleshooting, which BPOs increasingly need, according to Madrid.

During the pandemic, the Philippines’ outsourcing industry added 255,000 jobs, representing growth that’s at least 1% below the global expansion, he said. That suggests that the country may be losing market share to India as well as newcomers such as South Africa, Egypt, Poland, Colombia, Costa Rica.

Part of the problem is poor employability. Only one is hired for every 10 outsourcing job applicants, according to industry leaders.

The skills mismatch is becoming a more urgent issue as artificial intelligence threatens to disrupt industries worldwide. AI and similar technologies are projected to displace almost a quarter of the people in the Philippine outsourcing industry by 2030, according to the Asian Development Bank.

AI’s impact on the industry will be felt in a few years, and BPO workers should start learning how to use new technology to make their jobs more efficient, Madrid said. “There is time to prepare and upskill, but the time is shortening.”

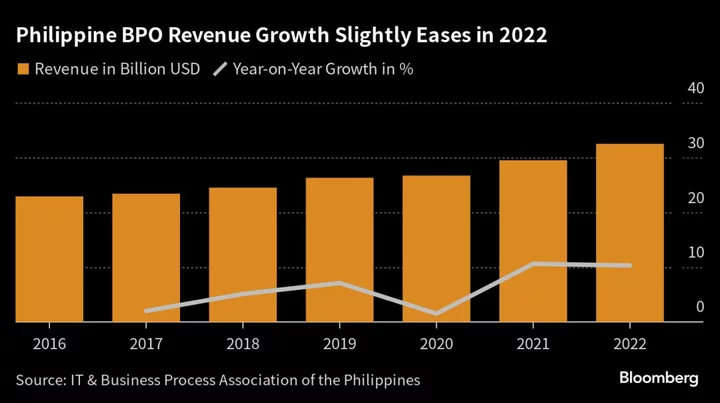

Despite these challenges, the industry group head still projects an increase of 6%-7% this year in full-time BPO employees from 1.57 million in 2022 while revenues are seen to grow 7%-8% to about $35 billion.

The outsourcing industry has mapped out a plan to create 1.1 million new jobs and become a $59 billion industry with 2.5 million employees by 2028. It seeks to increase its contribution to economic output to nearly 9%, as it targets to boost its market share in Europe.

Currently, prospective investors continue to pour in and existing ones remain keen on expanding their presence in the country. “There is continuing significant demand for our industry here in the Philippines. It doesn’t seem to wane despite all the headwinds,” he said.

The group has partnered with the Philippines’ Commission on Higher Education on initiatives including a revamp of the IT education program to align with current trends and develop competencies in the sector.

“There are some fundamental weaknesses in our educational system,” Madrid said. “It’s an old problem but it’s just become much more urgent now.”

(Updates with comment that demand for Philippine outsourcing workers remain robust in 14th paragraph.)