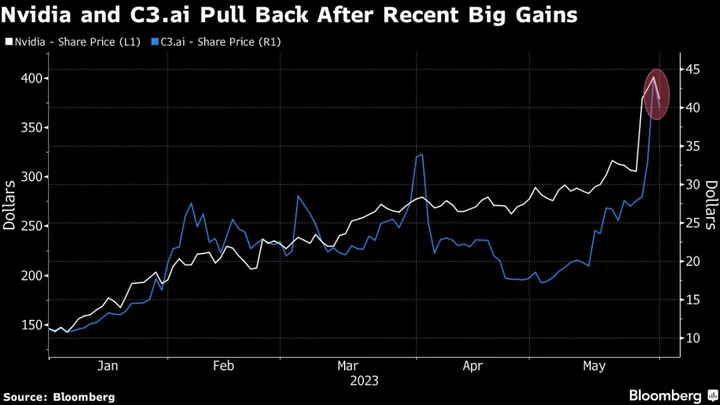

The rapid rally in tech stocks benefiting from artificial intelligence has stalled as Nvidia Corp. slipped after surging over 30% in three days and a disappointing outlook from C3.ai Inc. sparked a selloff in its shares.

AI software firm C3.ai fell 20% in US premarket trading on Thursday, extending yesterday’s drop of 9% on disappointing sales outlook, paring its gain for the year to just under 260%. Nvidia declined 5.7% Wednesday, the most since Jan. 30, after the chipmaker briefly reached a $1 trillion market cap earlier this week.

Wall Street has been obsessed with everything AI this year, with Nvidia’s blowout revenue forecast adding fuel to the frenzied rally. But lofty valuations — Cathie Wood says it’s “priced ahead of the curve” — are a reason for caution in the still nascent industry.

Read more: Nvidia Touches $1 Trillion Mark After Beating Rivals to AI

Cracks appeared in Asia as well, with three Nvidia suppliers cooling after big gains in May. Taiwan Semiconductor Manufacturing Co. fell for a third-straight day while Tokyo-listed Advantest Corp. and South Korea’s SK Hynix Inc. are little changed over the past two sessions.

Nvidia is expected to be the prime beneficiary of the wave of demand for generative AI like ChatGPT. That’s left some wondering if the world’s most valuable chipmaker is now too pricey.

Even after its latest dip, the stock is trading at 23 times estimated sales for the current year. That compares with less than 15 times for both Lattice Semiconductor Corp., which has the second-highest valuation on the Philadelphia Semiconductor Index, and C3.ai, the small cap software maker whose ticker is “AI”.

Read more: Nvidia’s Artificial Intelligence Rise Explained in Three Charts

The AI faithful are unlikely to be shaken by a few down days, however. Nvidia co-founder and Chief Executive Officer Jensen Huang, whose personal fortune has grown by $20 billion this year according to data compiled by Bloomberg, says companies that refuse to take full advantage of the opportunities provided by AI “will perish”.

Nvidia has 49 buy recommendations, more than all but four stocks on the Nasdaq 100. Its shares have seen a proliferation of bullish bets in the options market, with the highest trading volume Wednesday in July $500 and $550 calls, which bet on 32% and 45% increases respectively within the next seven weeks.

“At the current moment, the AI boom is shifting the financial fortunes of one company: Nvidia,” Vital Knowledge’s Adam Crisafulli wrote in a note to clients. “Every company on the planet is talking about how they’re AI plays, but only NVDA is seeing a stairstep shift in its income statement because of the technology.”

--With assistance from Joanna Ossinger.

(Updates with US premarket movers in the second paragraph)